Key Elements of a Journal Entry Posting

Learn the essential components for accurately posting journal entries in accounting

An accounting journal entry is a way of entering transactions into the accounting records of a business by debiting or crediting account balances. This can be done manually or through automation.

Journal entries follow the double-entry rule of accounting, which means that at least two accounts will be affected by each transaction, i.e. increased or decreased via a credit or a debit entry.

Example: If you paid $10 in cash for a pen, your Cash account will decrease by $10, while your Office Supplies Expense account will increase by $10.

This is an example of a simple journal entry, with only two lines. More complex entries are called compound journal entries and can have virtually unlimited lines.

Ensuring Balance: Balanced Entries

The totals of the debits and credits columns must always equal each other, which will ensure the journal entry to be "in balance". If you are using an automated accounting platform, you will not be able to post a journal entry unless it is balanced.

Key Elements

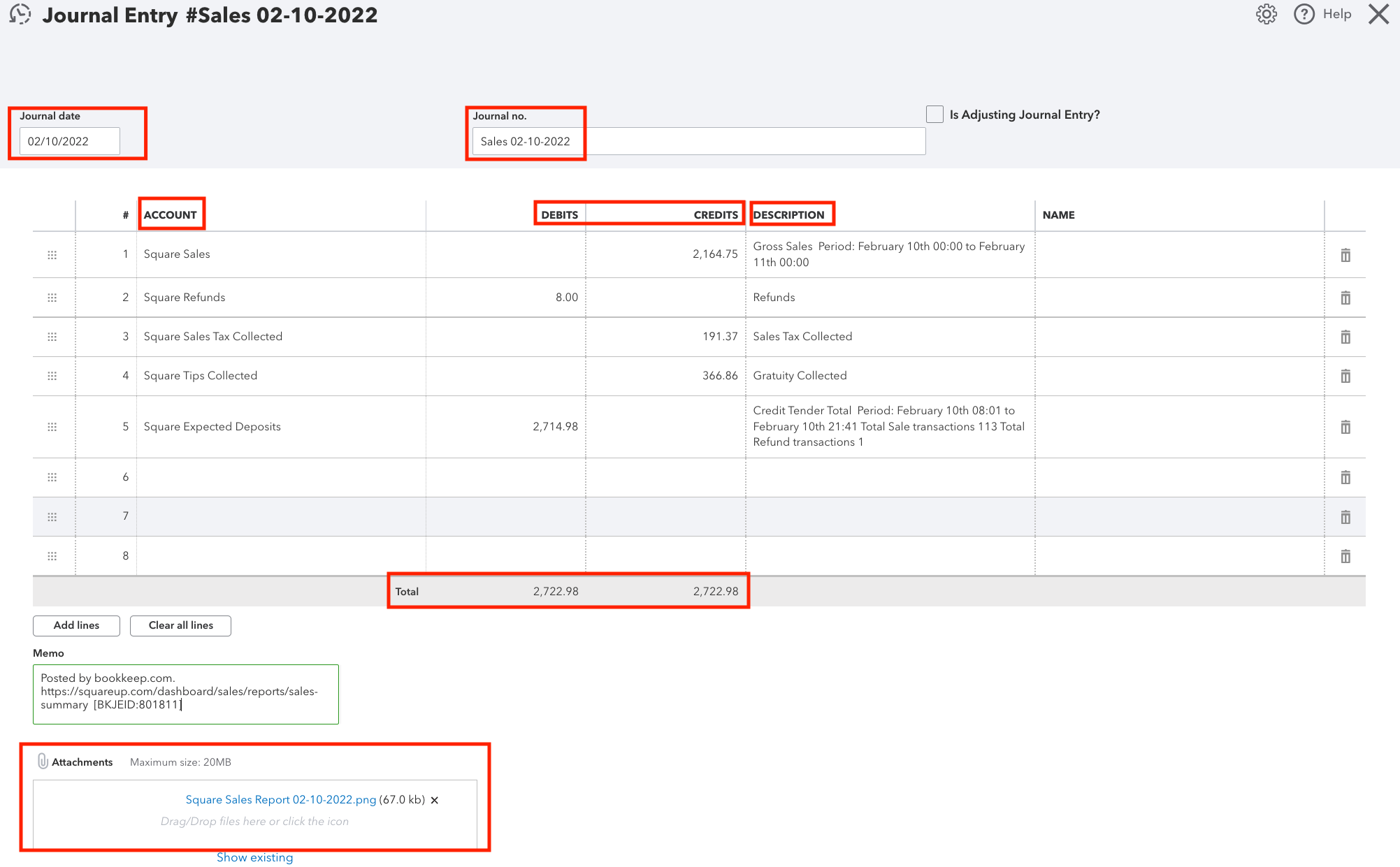

The key elements of a journal entry are:

| Element | Description |

|---|---|

| Journal Entry Number | A unique identifier for each transaction that usually has a limit for the number of characters allowed, depending on your accounting platform. It should be concise, relevant to the journal entry, and easy to recognize (e.g. Sales 02-10-2022, July Cash Expenses etc.) |

| Date | Indicates the accounting period for the entry |

| Accounts | These are from your chart of accounts, grouped into categories such as assets, liabilities, equity, revenue, and expenses, and used for recording transactions in the organization's general ledger |

| Debits and Credits | Columns that differentiate the amounts that increase or decrease the account balances |

| Description/Memo | A brief description of the journal entry or each individual line |

| Attachments | Attached documents to support the journal entry (e.g. a sales report, an available scanned receipt if recording an expense) |

The location and names of these key elements might vary depending on your accounting platform.

See the below QuickBooks Online journal entry sample to help identify the above elements:

To eliminate any potential mistakes or errors, journal entries should be recorded by accounting professionals as they possess a deep understanding of the accounting rules and have a better control over how these entries impact your financial statements.