What is a Balance Account?

A balance (or clearing) account tracks the funds currently held by a specific sales or payment platform, such as Shopify, and ensures accurate reporting and reconciliation in financial systems like QuickBooks or Xero.

For example, if you use Square for your retail or restaurant business, the funds you accumulate there should be treated like a bank balance. Each unique balance—whether from Square, Amazon Seller, Shopify, or PayPal—requires its own dedicated balance account in your accounting platform such as QuickBooks or Xero. Just as you wouldn’t combine multiple bank accounts into one, each sales platform or deposit source needs a separate account to ensure accurate financial reporting and reconciliation.

Common Misconceptions and Best Practices

It’s common to mistakenly consolidate multiple balances into a single account, such as combining sales from three different restaurant locations into one QuickBooks clearing account. Doing so prevents accurate reconciliation. Each deposit source should have its own balance account to maintain clarity. The guiding principle: one balance account per regular deposit.

Journal Entry Practices for Multiple Platforms

Daily journal entries typically include both sales and deposits. Sales from the prior day—across platforms like Stripe, Square, Shopify, or Amazon—are booked against the respective balance account. Deposits to your bank are then recorded as reductions in these balance or clearing accounts.

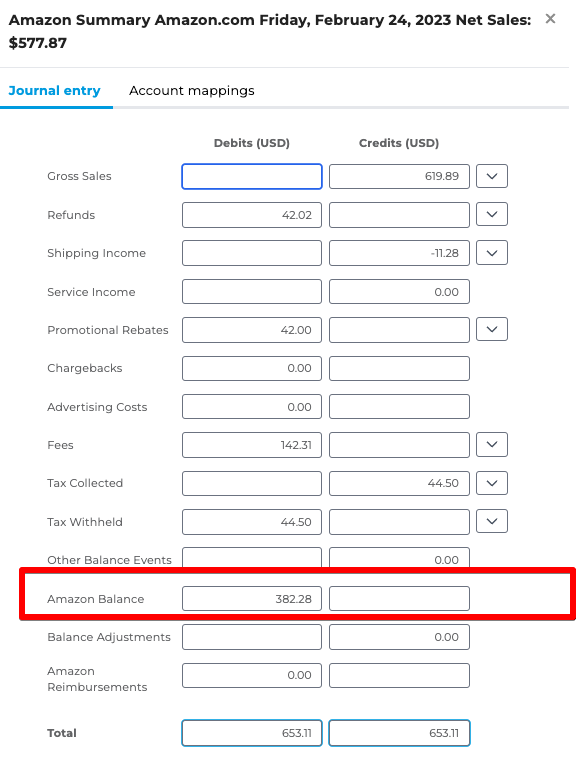

Amazon Seller

Daily sales are booked to an “Amazon Balance” account and reduced when funds transfer to your bank.

Shopify and PayPal

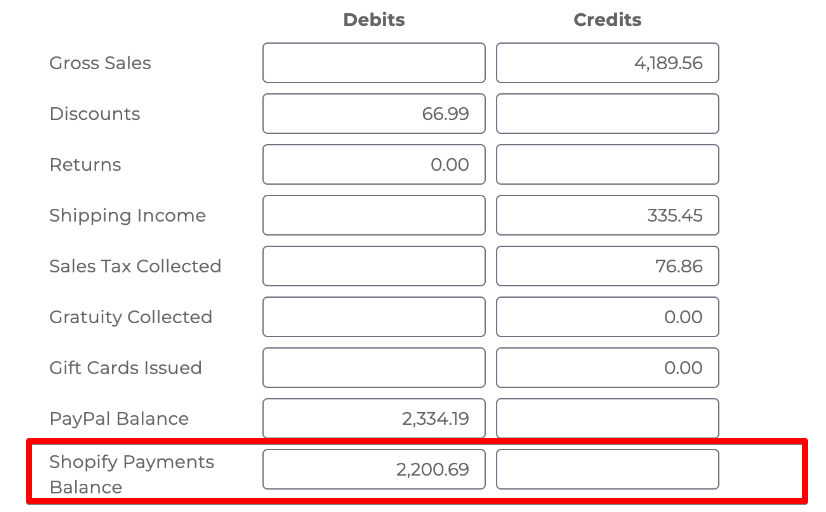

In this Shopify Summary example below, this customer completed sales that were processed by PayPal and Shopify.

Shopify acts as both a sales and payment platform, so sales increase the Shopify balance account.

In this case PayPal is acting only as a payments platform. For PayPal, an Inter-App clearing account tracks the transactions reported by Shopify versus actual PayPal activity. Once the funds are transferred from Shopify to PayPal, this inter-app clearing account would be reduced.

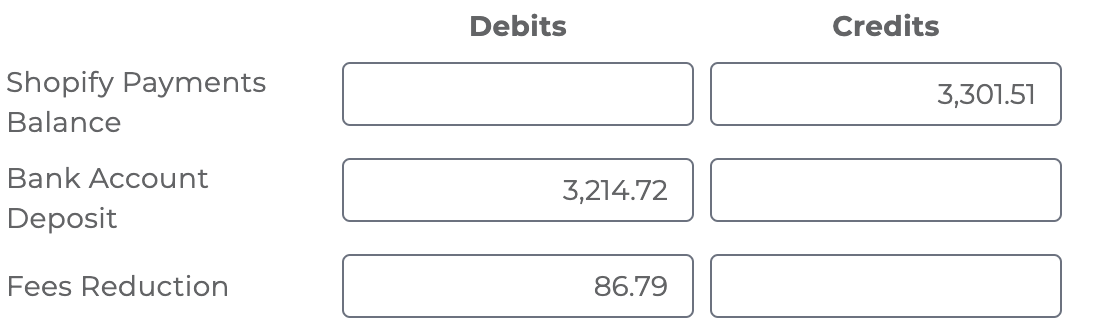

Balances may remain in-platform or be deposited to your bank, similar to how a bank account operates. Fees deducted by platforms like Shopify or PayPal reduce the balance, which is then reconciled when funds reach your bank.

The Dynamics of Balance Accounts

Balance accounts grow as sales occur and decrease as deposits are made. Mapping sales and deposit journal entries to the same balance account ensures accurate reconciliation and a clear view of expected versus actual deposits. As retailers and ecommerce sellers use more sales and payment platforms, maintaining these accounts has become essential for accurate financial management.

In the example below, Shopify deducts fees, reducing the amount deposited to your bank, and the Shopify balance account decreases accordingly as the funds are transferred.

Need help? If you’re unsure about the correct setup for clearing or balance accounts in Bookkeep, our team is here to help. Contact us at [email protected] for guidance and best practices to ensure accurate financial reporting.