Amazon Seller Accounting Automation Offered by Bookkeep

Bookkeep allows you to seamlessly link your Amazon Seller account for automated daily accounting tasks, such as tracking sales from the previous day and incoming bank transfers. Amazon operates in three regions, giving you the option to choose the specific region you want to connect. Once selected, Bookkeep will automatically sync all marketplaces within that region where you are active. For instance, selecting North America will link you to the United States, Mexico, and Canada marketplaces. You have the flexibility to exclude any marketplaces you do not want to automate. For more details on the connection process, you can refer to our How to Connect Article.

Flexible Account Mapping

Through our connect process, we provide the flexibility for you to create a distinct account mapping for each marketplace you are active in. This feature allows for more detailed and accurate tracking of your sales performance across different marketplaces. By setting up separate account mappings, you can easily analyze and compare the financial data specific to each marketplace, giving you valuable insights into the profitability and trends of your sales activities.

Please note that Amazon only allows us to retrieve 2 years back from the current date when importing historical financial data.

Automated Journal Entries

The two journal entry postings we automate on a daily basis with Amazon Seller are:

- Amazon Sales Summary

- Amazon Deposit

Amazon Sales Summary

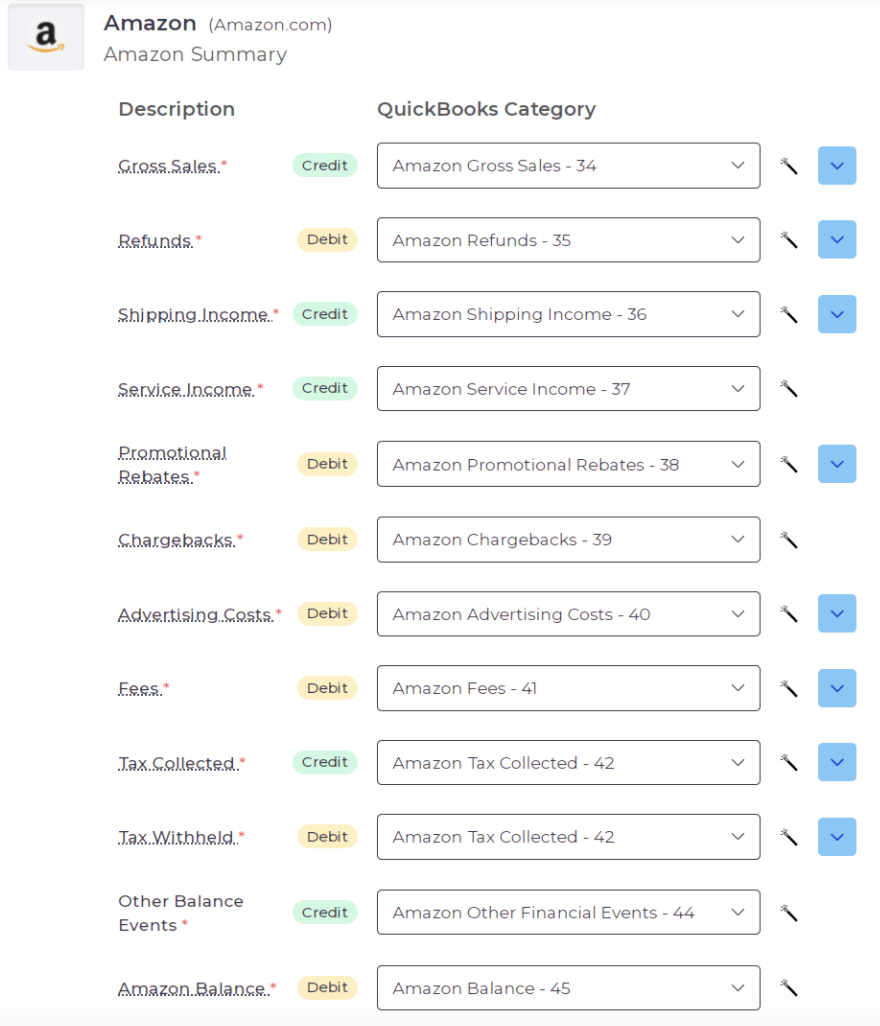

The Amazon Sales Summary journal entry posts to your accounting platform on a daily basis, providing a detailed breakdown of your sales activities from the previous day. It meticulously captures the transition from gross sales to net sales, taking into account any discounts, refunds, or other adjustments. Moreover, this entry also meticulously records the various fees charged by Amazon, ensuring a comprehensive overview of your financial transactions on the platform. See below for an example mapping:

Subcategory Breakdown

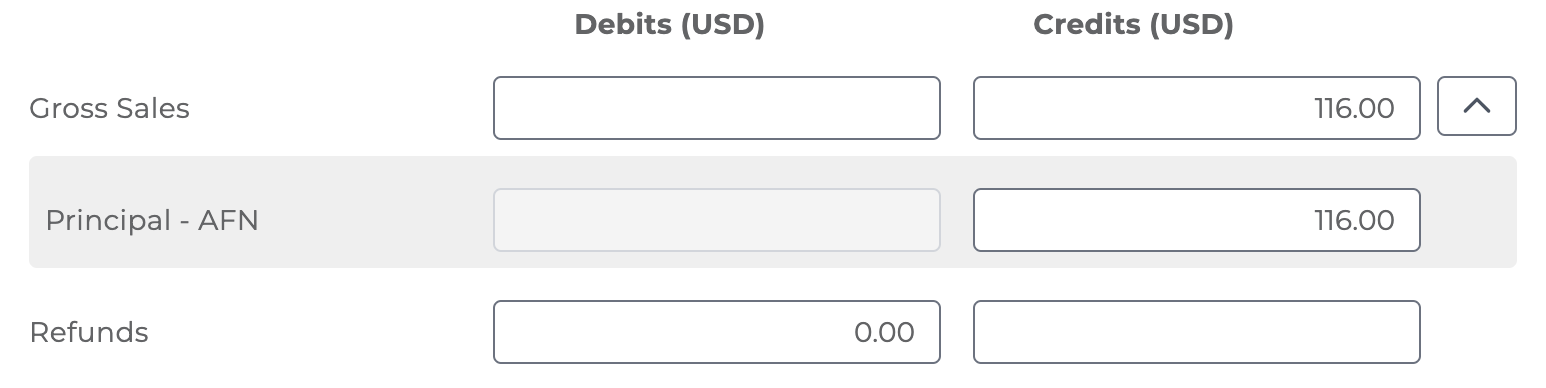

We break down the subcategories for gross sales and refunds based on the fulfillment type, where data is available. For instance, if $100 in sales is split as $60 from AFN (Amazon Fulfillment Network) and $40 from MFN (Merchant Fulfilled Network, Amazon's term for Fulfilled by Merchant), we categorize them accordingly to help you track sales per fulfillment network as shown below:

This breakdown of AFN vs. MFN makes it much easier to tie out to the Amazon reporting as shown below:

Our corresponding subcategories are shown below which align with the reporting displayed above from Amazon:

- Gross Sales:

- "Principal - AFN": $184,723.55

- "Principal - MFN": $22,211.17

- Refunds:

- "Principal - MFN": $183.39

- "Principal - AFN": $7,924.06

- "Goodwill - AFN": $24.99

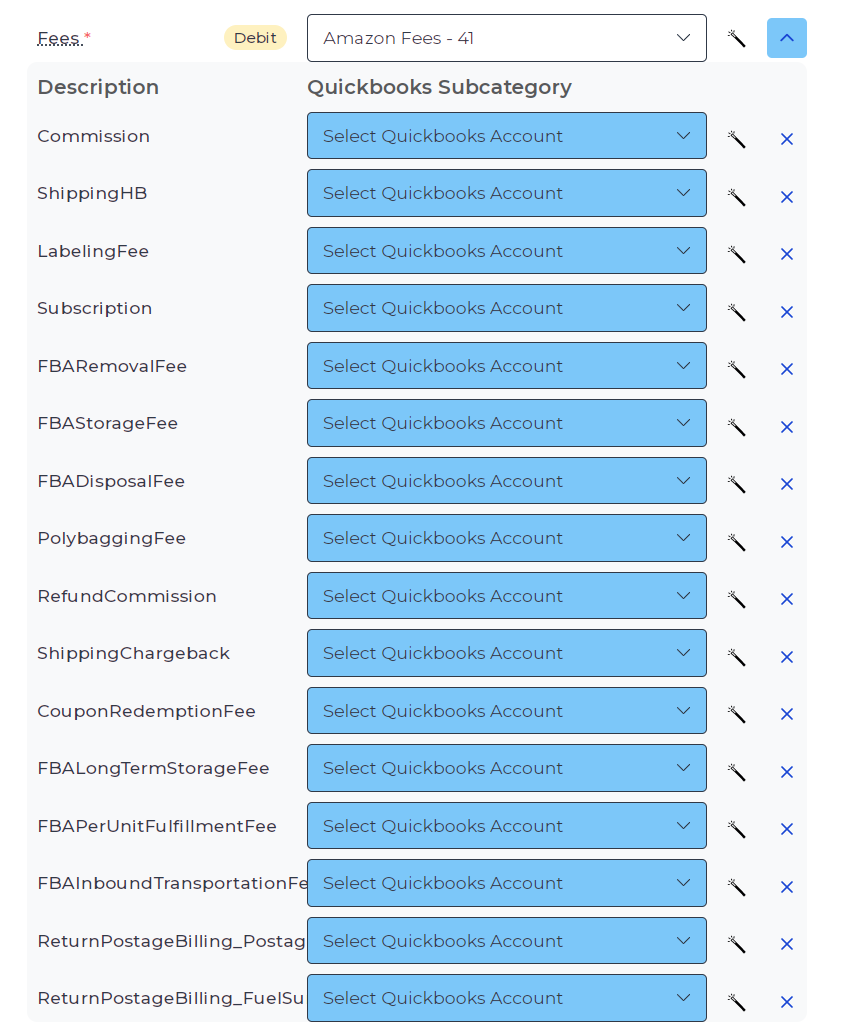

For additional lines in this journal entry, we also provide subcategories for mapping. For example, "fees" can be broken down and mapped to specific accounts, i.e. Shipping Expenses, Commission, etc.

This is not a mandatory step, and each unmapped subcategory will post to the parent category/account.

Sales Tax Handling

In the case of Amazon sales, it's important to note that we include the capturing of Sales Tax Collected and Withheld. In the USA, Amazon withholds and pays the tax on your behalf, so we recommend mapping both lines to the same accounts to balance out to zero. However, in Canada, the seller is responsible for paying the tax. Therefore, the withheld line can be mapped to an account that will be used to settle the actual sales tax later on.

Amazon Deposits and Splits

When it comes to Amazon deposits, there are specific cutoff times that determine how sales from a day are split into future deposits. In these scenarios, Bookkeep will create two entries in a day to show this split. You might notice "Pre" or "Post" in the journal entry summary, indicating this split. Essentially, sales recorded in the "Pre" entry will be included in the next payout, while sales in the "Post" entry will be part of the following payout.

Amazon Deposits and Splits

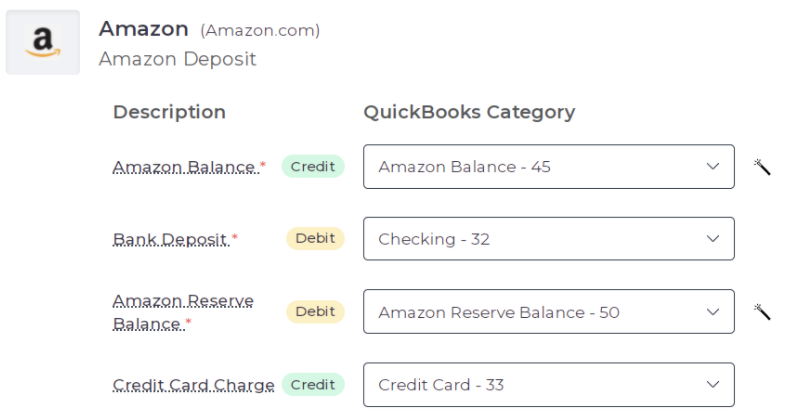

The second journal entry we support for Amazon Seller is the Deposit journal entry.

This journal entry captures any new deposits coming to your bank account related to Amazon sales. Your Amazon balance captures any sales that were processed by Amazon resulting in an increase to your Amazon balance. This Amazon balance is then decreased any time there is a deposit to your bank account which is captured in this journal entry. Note that payouts (deposits) from Amazon usually come into your bank account every other week (usually twice a month), unless you have special arrangements with Amazon. The Amazon Reserve Balance indicates any money withheld by Amazon between payouts, usually to cover any unfulfilled orders or potential returns/refunds. See below for an example mapping:

If you have linked a credit card to your Seller account for Amazon to charge in case your Amazon Balance is insufficient, please map the "Credit Card Charge" to that specific credit card account.

Amazon Pay Transactions

Lastly, it is important to mention that certain Amazon Seller accounts include Amazon Pay transactions. If Bookkeep detects these transactions, a third daily entry related to Amazon Pay will be generated. Learn more about the Amazon Pay journal entry.

If you have any questions regarding our Amazon journal entries, feel free to contact to [email protected].