Etsy Journal Entry Types

Bookkeep enables you to integrate your Etsy store to automate journal entry postings.

The two journal entry postings we automate with Etsy are:

- Sales Summary

- Deposit

Sales Summary Journal Entry

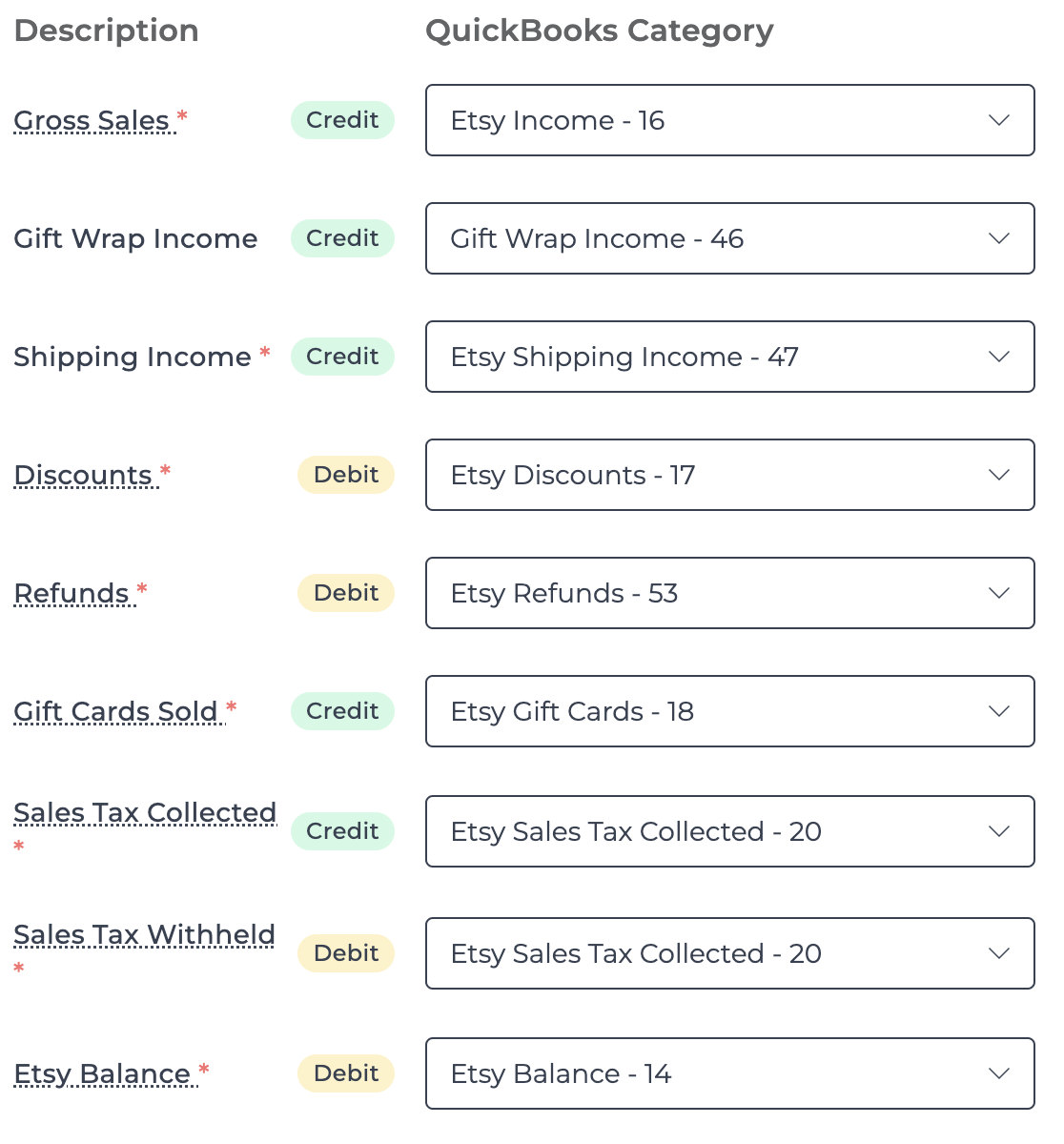

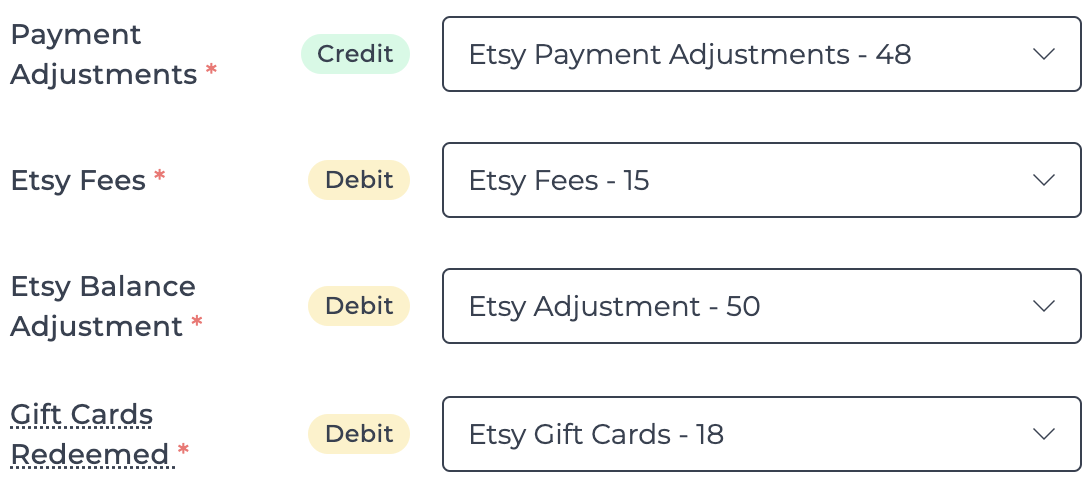

The Sales Summary journal entry posts daily sales from the prior day to your accounting platform. It captures the gross sales down to the net sales, including discounts, refunds, and various fees from Etsy. Below is an example mapping:

We capture Sales Tax Collected and Withheld. In the USA, tax is withheld and paid by Etsy, so we recommend mapping these two lines to the same accounts since they should net to zero. In Canada, the seller must pay the tax, so the withheld line should be mapped to an account for future payment.

Map the gift cards sold and redeemed lines to the same account since they affect the same accounts as gift cards are sold and later used.

Deposit journal entry

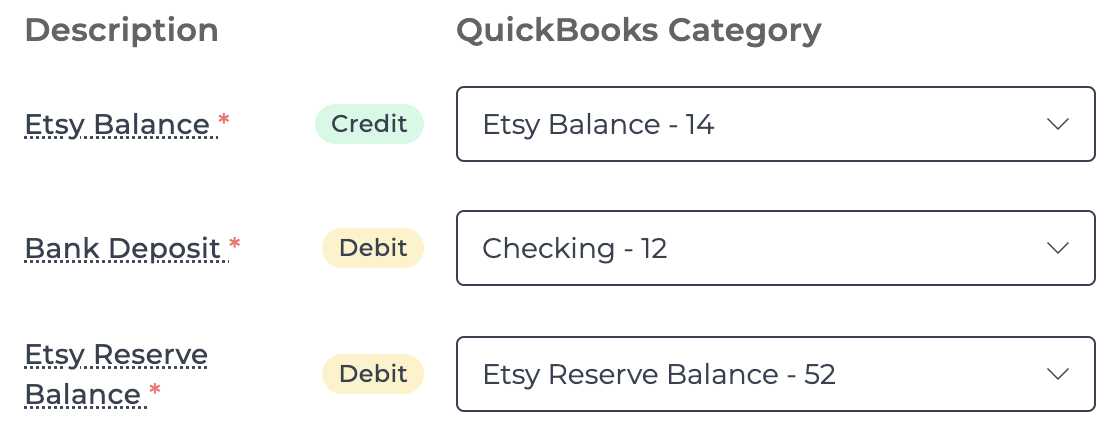

The Deposit journal entry captures new deposits to your bank account related to Etsy Payments daily. It represents any sales processed by Etsy, increasing your Etsy balance, and decreases the balance with each deposit. Below is an example mapping:

Etsy deposits may have cutoff days where part of a day's sales are deposited later. Bookkeep will post two entries to indicate this split, marked as Pre or Post in the journal entry summary.

If you have any questions regarding our Etsy journal entry templates, please contact [email protected].