How to Properly Account for Square House Accounts with Bookkeep

Square House Accounts allow businesses to extend credit to customers, enabling purchases with payment deferred to a later date. This article explains how to properly account for Square House Accounts using Bookkeep.

What Are Square House Accounts?

Square House Accounts act as an internal credit system managed by the business, allowing customers to accumulate charges and settle their balance at a later time. Key features include:

- Customer-Specific Credit: Customers can make purchases without paying upfront, with balances settled periodically.

- Payment Flexibility: Billing can be done on a schedule (e.g., monthly), offering convenience and fostering customer loyalty.

- Customized Terms: Businesses can set credit limits and payment terms for each customer.

- Invoicing and Payments: Square enables businesses to send invoices to customers, making it easy to settle balances.

Use Cases for Square House Accounts

- Recurring Customers: Perfect for businesses with repeat customers who prefer to settle their bills monthly, such as cafés billing local businesses.

- Corporate Accounts: Extend house accounts to corporate clients, allowing representatives to make purchases billed to the company.

- Service-Based Businesses: Ideal for service providers billing clients after work is completed.

Proper Accounting for Square House Accounts

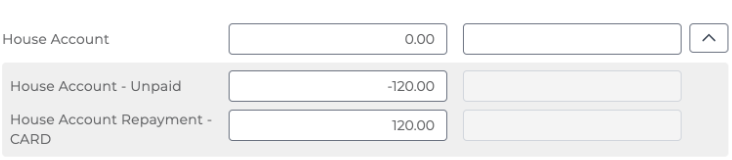

Accounting for Square House Accounts involves tracking sales, outstanding receivables, and payments. Since house accounts operate as internal credit lines, they impact both Sales and Accounts Receivable. Below are the key steps for accurate accounting:

Step 1: Record Sales on Credit

When a customer makes a purchase on their house account, it is treated as a sale on credit. The sale should be recorded even if the payment is pending.

Journal Entry (At Time of Sale):

- Debit: Accounts Receivable (amount charged to the house account)

- Credit: Sales Revenue (same amount)

This reflects that the sale was made, but the payment is pending as a receivable from the customer.

The unpaid subcategory can be mapped to a general receivable account for the Square location.

Step 2: Send Invoices and Collect Payments

When a payment is due, send an invoice through Square. Once the payment is received, record the transaction to close the receivable.

Journal Entry (Upon Payment):

- Debit: Cash/Bank/Tender Type (amount paid)

- Credit: Accounts Receivable (reduce the receivable)

This entry reduces the receivable balance and reflects that the payment was collected.

Example Workflow

- Customer Purchase (on credit): Record the sale as a credit sale, increasing Accounts Receivable.

- Invoice Generation: Send an invoice at the end of the billing cycle.

- Payment Receipt: Record the payment and reduce Accounts Receivable.

Important Considerations

- Cash Flow: Credit sales delay cash flow, so it's important to manage cash carefully, especially if house accounts represent a significant portion of sales.

- Credit Risk: Monitor house accounts for overdue balances to avoid bad debts.

By properly managing Square House Accounts with accurate accounting practices, you can maintain clear visibility into sales and receivables. For any questions, contact [email protected].