What is Partial Payments Deferred Revenue (Square)?

In this article, we summarize how Bookkeep customers can map Square Invoices data through our system.

Understanding Deferred Revenue

"Deferred revenue" is a liability on a company's balance sheet, representing prepayments for goods or services to be delivered on a future date. Square Invoices allows Square customers to send invoices and estimates, schedule recurring invoices, schedule payments, and charge cards on file.

Mapping Square Invoices Data in Bookkeep

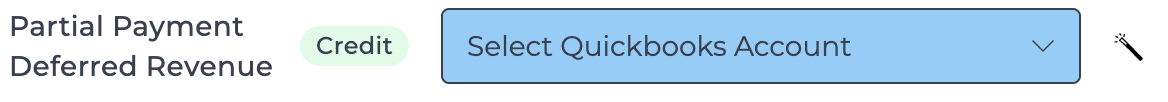

After you've connected your Square account to Bookkeep and start mapping your fields, you'll notice a field for "Partial Payment Deferred Revenue":

Once mapped, this field captures any partial payments made through Square Invoices and classifies them as liabilities. When an invoice is fully paid, Square will then recognize this as a sale, and the data will flow through accordingly.

As always, feel free to contact [email protected] if you have any questions.