Accounting for Stripe Capital Loans: A Comprehensive Guide

Introduction

Stripe Capital provides businesses with quick access to financing based on their payment processing history. Unlike traditional loans, Stripe Capital advances are repaid automatically through a percentage of daily sales processed through Stripe. This unique structure requires specific accounting considerations to ensure accurate financial reporting.

This guide covers the proper accounting treatment for Stripe Capital loans, including initial recognition and ongoing repayments.

Understanding Stripe Capital Loans

Key Characteristics

- Advance-based financing: Stripe Capital provides a lump sum upfront

- Fixed fee structure: Instead of interest, you pay a pre-determined fee

- Automatic repayments: A fixed percentage of daily Stripe transactions is withheld for repayment

- No fixed term: Repayment timeline varies based on sales volume

Initial Accounting Treatment

Journal Entries for Loan Origination

When you receive a Stripe Capital loan, it is generally recommended to record the fee as a prepaid expense and amortize it over the expected repayment period:

| Debits | Credits | |

|---|---|---|

| Cash/Bank | $10,000 (Loan amount received) | |

| Prepaid Financing Costs | $1,500 (Fixed fee amount) | |

| Loan Payable | $11,500 (Total repayment amount) |

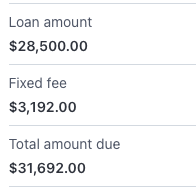

Bookkeep automates the issuance of the amount paid out net of fees. For example, below shows a loan from Stripe where the total loan is $28,500 and the $3,192 fixed fee is withheld. Ultimately, the business will repay Stripe $31,692 which includes the principal and fee, but the bank account only receives $28,500 (found by locating the loan here: https://dashboard.stripe.com/capital):

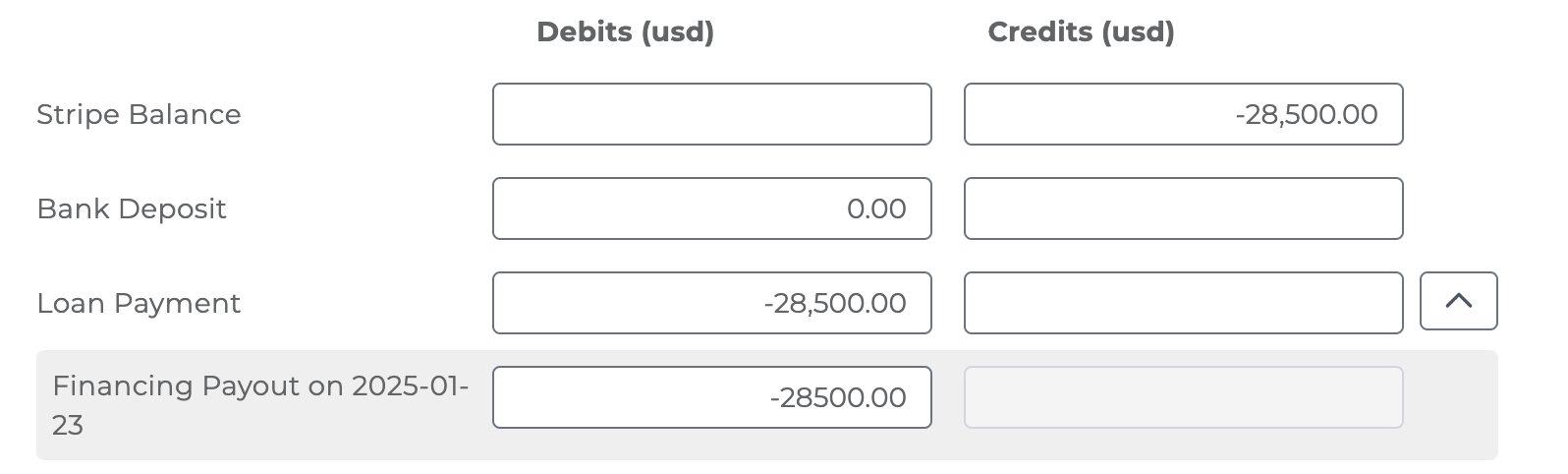

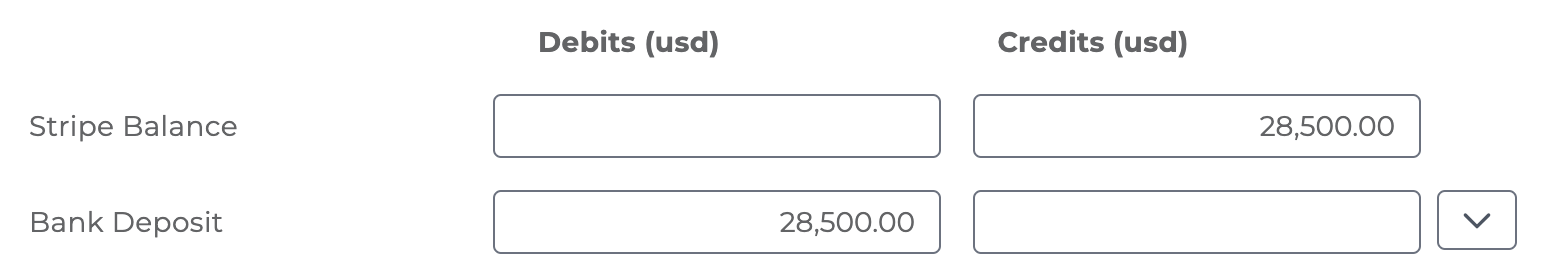

Bookkeep first captures the increase to the Stripe balance due to the loan issuance:

Separately, Bookkeep captures the transfer of this loan to your bank account:

One thing to note is the fixed fee that is withheld from Stripe can be located in Stripe and manually recorded as a prepaid financing cost as called out above (details can be found by selecting the specific loan here: https://dashboard.stripe.com/capital).

Ongoing Accounting

Recording Daily Repayments

When Stripe withholds a percentage of daily sales:

| Debits | Credits | |

|---|---|---|

| Loan Payable | $115 (10% of daily sales of $1,150) | |

| Stripe Balance | $115 |

If using the prepaid expense approach, also amortize a portion of the financing cost (this could be done once at month end to capture the change in fees owed):

| Debits | Credits | |

|---|---|---|

| Financing Cost/Interest Expense | $15 (Proportional amount of fee) | |

| Prepaid Financing Costs | $15 |

Bookkeep automates the loan repayments daily as shown below:

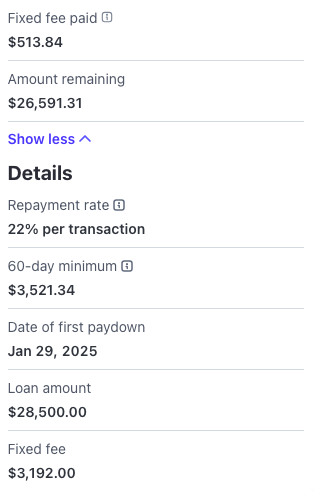

This $32.40 is a direct reduction to the loan payable due. In the example above, the total repayment amount is $31,692 which includes the principal and interest. This repayment entry is done daily if there is any repayment activity. Stripe does not share the amount of fixed fee paid so it is advisable to manually reduce the prepaid financing cost and recognize this amount as interest/financing cost paid on a monthly basis. This data can be retrieved from the Stripe Capital dashboard:

For example, $513.84 of fees has been paid so the following entry can be made:

| Debits | Credits | |

|---|---|---|

| Financing Cost/Interest Expense | $513.84 | |

| Prepaid Financing Costs | $513.84 |

This manual adjustment can be done monthly by determining the change in fee amount paid from the Stripe Capital dashboard.

Accounting Software Setup

QuickBooks and Other Platforms

- Create accounts:

- Liability account for the loan

- Expense account for financing costs

- Prepaid financing cost account if using the prepaid approach

- Set up recurring journal entries:

- Automatic daily entries for repayments (Bookkeep fully automates this)

- Monthly entries for financing fee amortization (if applicable)

Common Accounting Challenges

Estimating Repayment Timeline

Since repayments are tied to sales volume, estimate the expected repayment period based on:

- Historical sales patterns

- Seasonal fluctuations

- Growth projections

Regularly revisit these estimates and adjust accounting treatments accordingly.

Reconciling with Stripe Dashboard

Regularly reconcile your accounting records with the Stripe Dashboard to ensure accuracy:

- Compare outstanding balance

- Review daily repayment amounts

Conclusion

Proper accounting for Stripe Capital loans ensures accurate financial reporting and helps track the true cost of this financing option. Because of its unique repayment structure, regular monitoring and adjustments are necessary to maintain accurate financial statements.

Consult with your accountant for guidance specific to your business situation and applicable accounting standards.

If you have any questions on how Bookkeep can help you automate this process, please contact [email protected].