SumUp Revenue Accounting Automation

Bookkeep offers seamless integration with your SumUp accounts, enabling you to automate your revenue accounting processes. With this integration, you can easily track and manage your SumUp sales, processing fees, and deposits in one central place.

By syncing your SumUp accounts with Bookkeep, you eliminate the need for manual data entry and ensure accurate, up-to-date financial records. The integration automates two crucial journal entry postings related to your SumUp transactions.

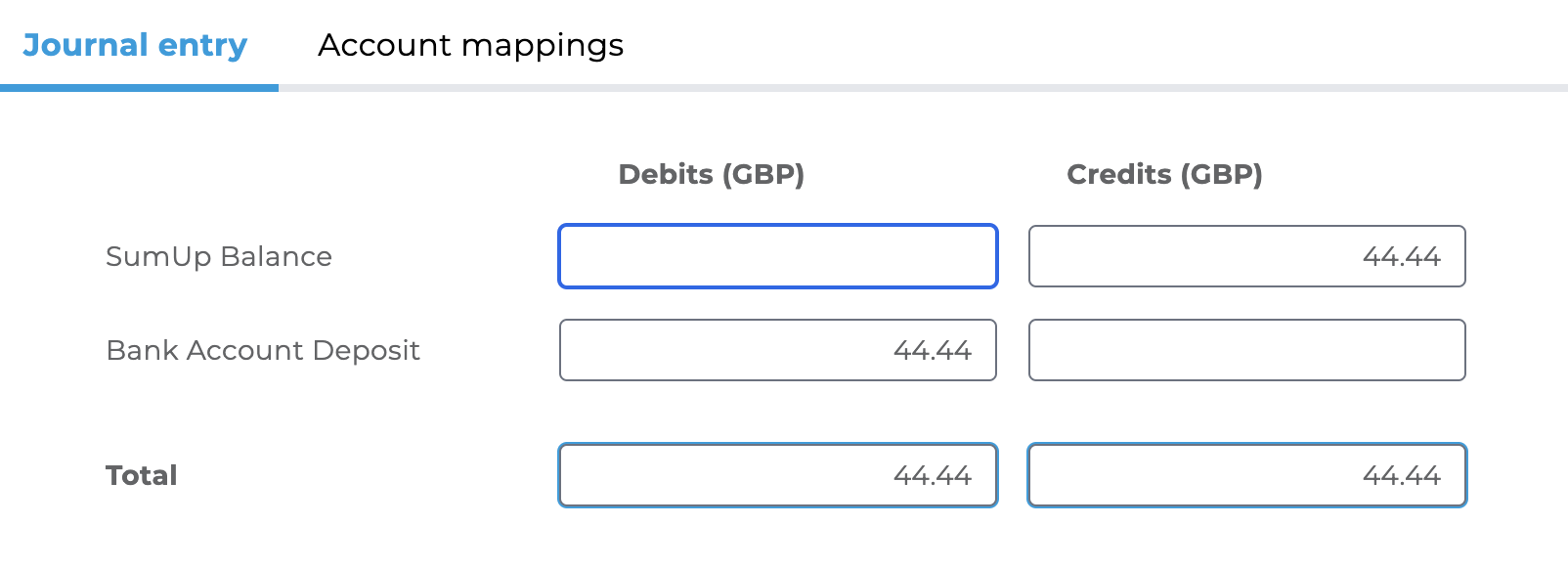

Deposits

The first journal entry automates the recording of payouts or deposits made to your bank account from SumUp. This entry captures any new deposits received daily. By automating this process, Bookkeep helps you accurately track and reconcile your incoming funds. Below is an example of a deposit entry where the SumUp balance decreases and the bank account balance increases:

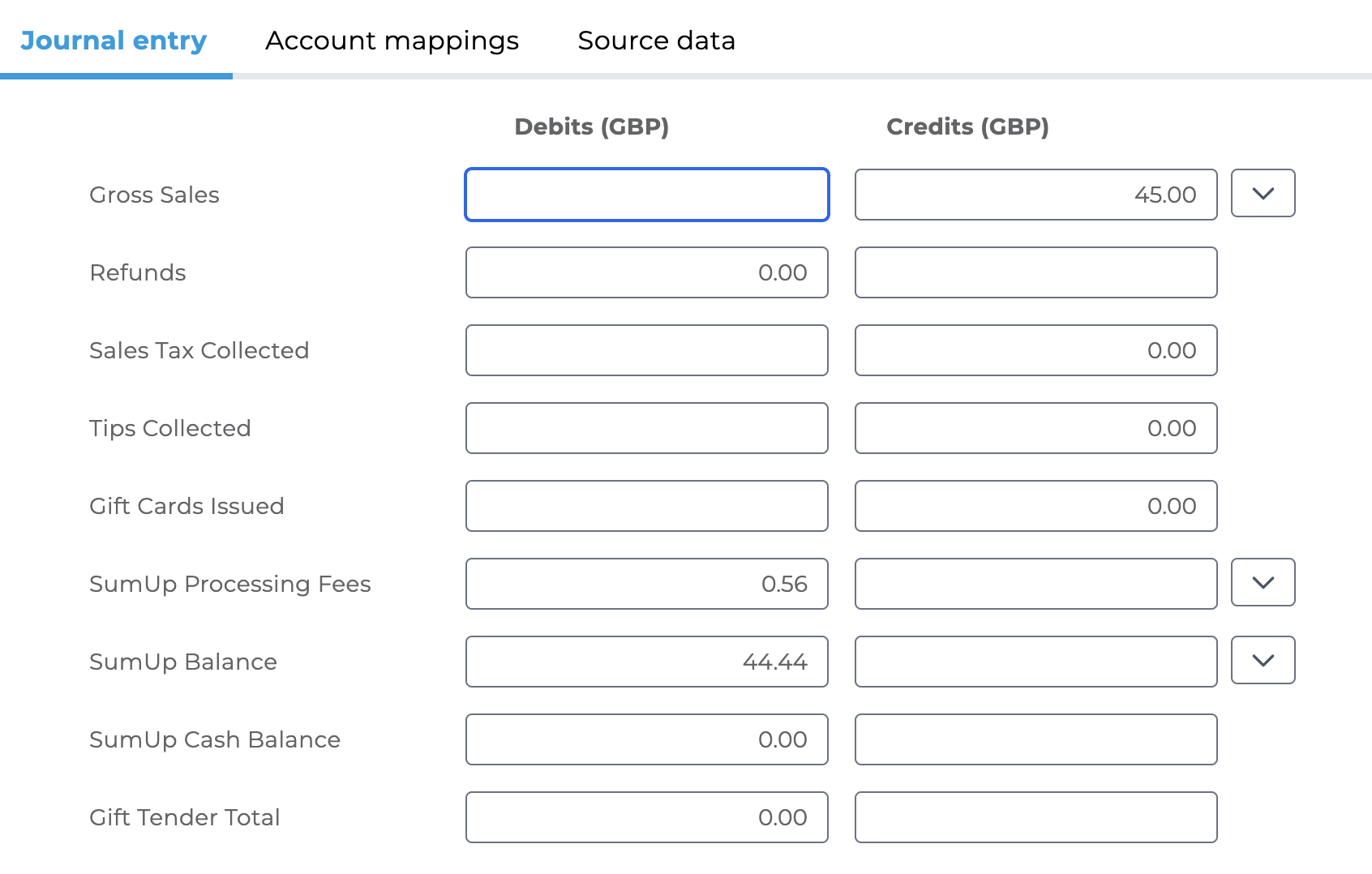

Sales Summary

The second journal entry automates the recording of your sales daily, with one summarized entry per currency to keep your books uncluttered. It captures the gross sales from the previous day and breaks them down to net sales, including any discounts or refunds. Additionally, this entry includes the fees associated with processing these sales. By automating this process, Bookkeep ensures that you have a clear overview of your sales revenue and associated expenses. Below is an example sales summary entry. Notice that the SumUp balance net of fees is 44.44, which reconciles with the earlier deposit journal entry. Bookkeep ensures that you can easily reconcile your books and verify that you have received the expected funds from your sales, helping you maintain accurate financial records and understand your revenue:

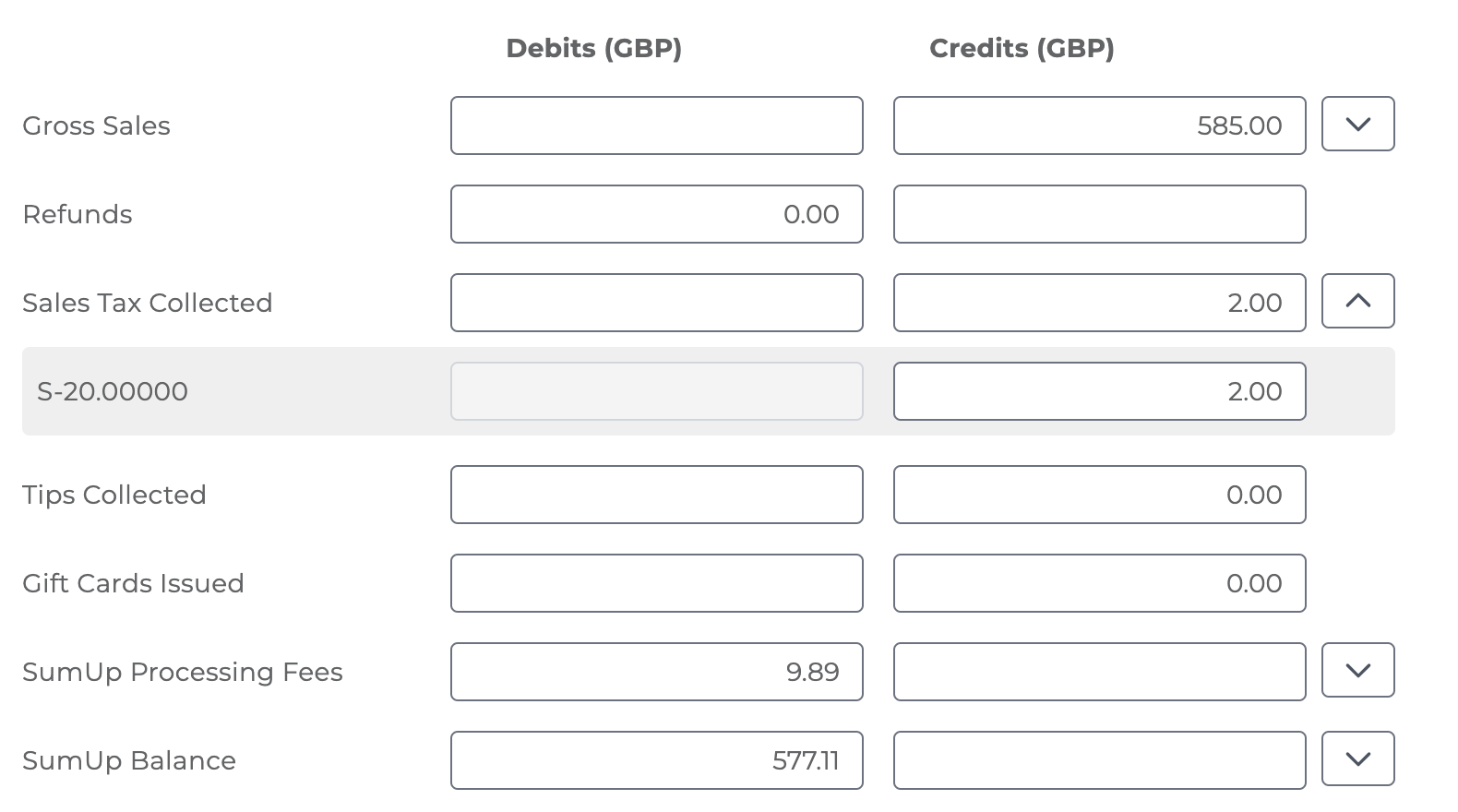

QuickBooks Online VAT support with SumUp

Bookkeep also provides support for businesses using QuickBooks Online in the UK, streamlining their VAT reporting for SumUp. By integrating with QuickBooks, Bookkeep allows you to map tax rates from your QuickBooks to accurately report VAT. This automation feature enables convenient VAT reporting within QuickBooks. Below is an example showing how VAT reporting is automated.

In this example, there was 2.00 of VAT collected under the sales tax collected line:

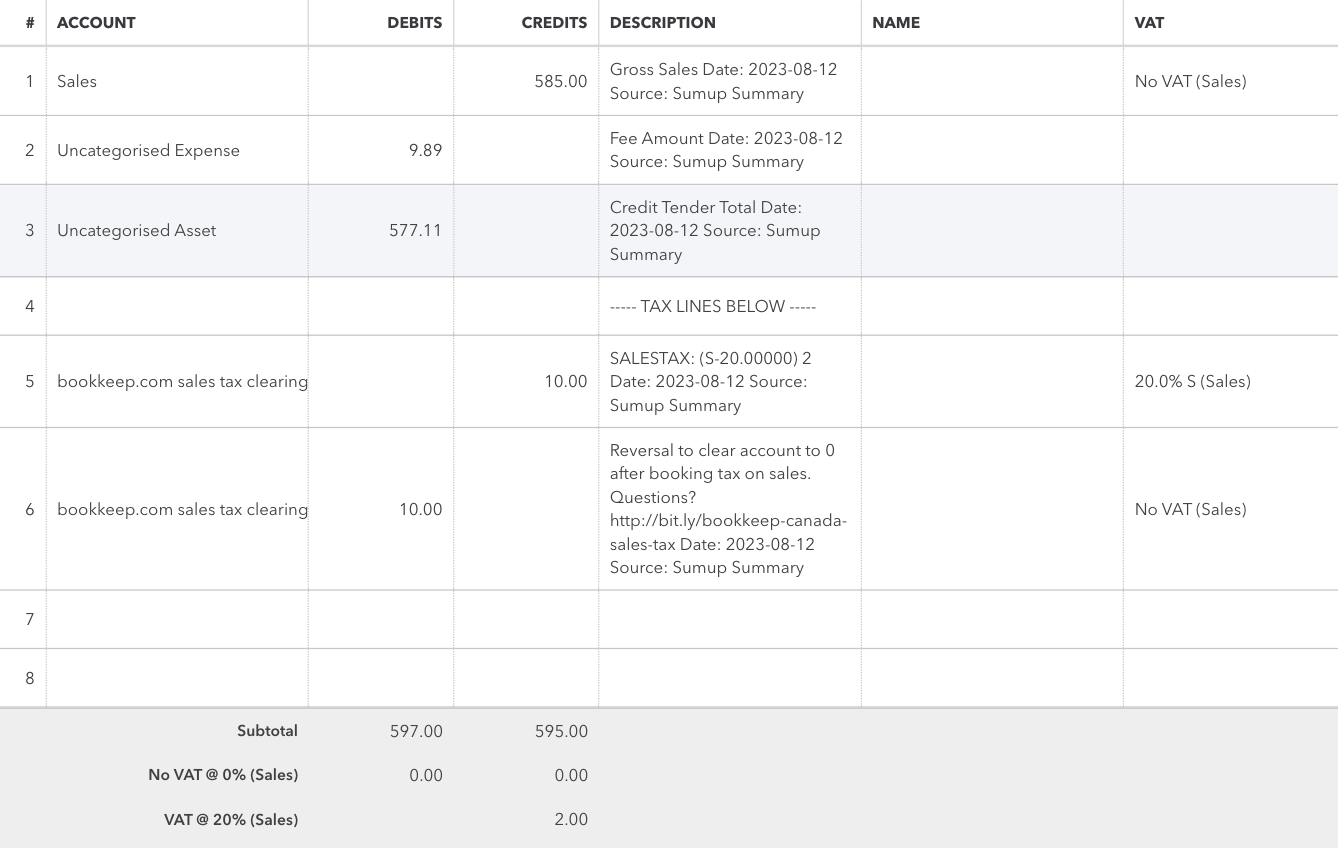

The corresponding entry in QuickBooks Online is shown below, where you can see the 2.00 of VAT reported at the bottom:

For additional information on the Bookkeep QuickBooks VAT reporting feature, visit here.

With Bookkeep's integration with SumUp, you can streamline your revenue accounting processes and have a comprehensive view of your financial transactions. If you have any questions or need assistance with SumUp revenue accounting automation, our support team is always available to help you. Simply reach out to us at [email protected].