Walmart US Journal Entries Offered by Bookkeep

Bookkeep simplifies the accounting process for Walmart US sellers by automating journal entry postings, ensuring accurate and up-to-date financial records. This guide explains the two types of journal entries Bookkeep automates for Walmart US.

The two journal entry postings we automate with Walmart US are:

- Walmart Sales Summary

- Walmart Deposit

Walmart Sales Summary

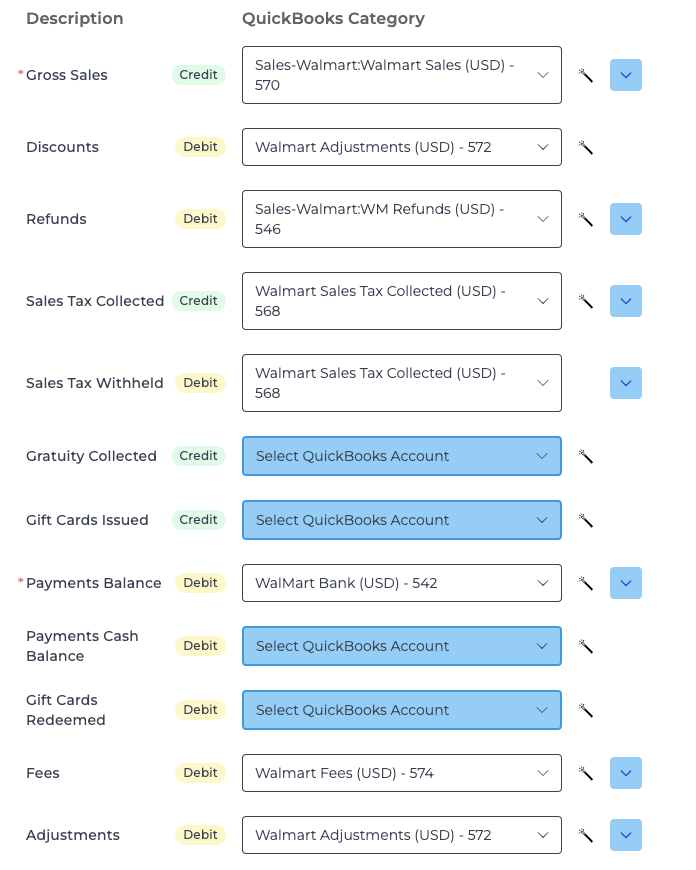

The Walmart Sales Summary journal entry posts the previous day’s sales to your accounting platform whenever a new settlement report from Walmart is available. Each settlement contains one deposit and several associated sales days. Bookkeep captures the gross sales down to net sales, including discounts, refunds, and various Walmart fees. The frequency of settlement reports can vary depending on your Walmart seller account.

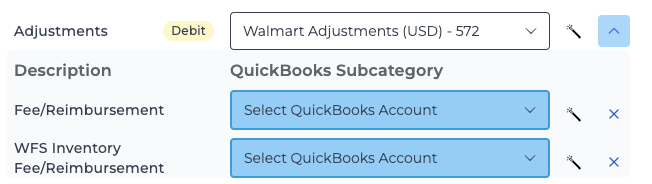

Subcategory Mapping

Certain lines in the Walmart Sales Summary journal entry, such as "adjustments," can be mapped to specific accounts using subcategories. This feature provides greater granularity in tracking your sales.

Mapping subcategories is optional. If no subcategories are mapped, each line will post to the parent category or account by default.

Sales Tax Collected and Withheld

For Walmart US, sales tax is withheld and paid by Walmart on your behalf. Bookkeep captures both Sales Tax Collected and Sales Tax Withheld, and we recommend mapping these lines to the same accounts, as they should net to zero.

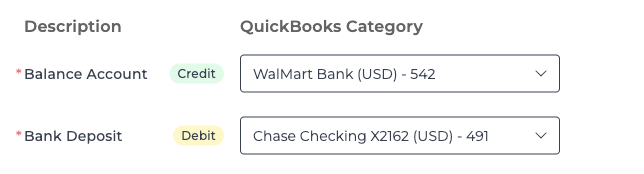

Walmart Deposit

The Walmart Deposit journal entry captures new deposits made to your bank account from Walmart US. Deposits typically occur every 1-2 weeks, though some accounts may experience monthly or longer intervals. Your Walmart Balance account reflects sales processed by Walmart, and this balance is decreased when deposits are made to your bank account, which Bookkeep records in the deposit journal entry.

If you have any questions regarding our Walmart journal entry templates, feel free to contact [email protected].