Bookkeep Sales Tax Reporting

Bookkeep offers sales tax reporting by label and month for various apps

This is supported with our Square, Mindbody, and Shopify app integrations.

Note that this reporting is only made available to Bookkeep Sales Tax filing customers.

Bookkeep now provides reporting for sales tax, which is available for the apps listed above.

We recommend you speak with your accountant and to the tax authorities you need to provide GST, VAT, or sales tax returns to, so you know your obligations.

If you have the apps connected which are supported, the left navigation will show "Sales Tax" as visible in the image below:

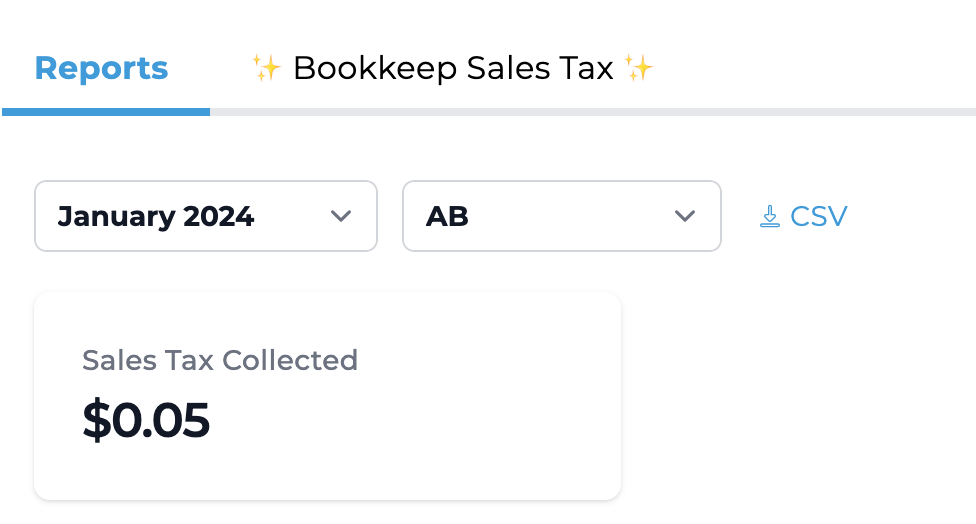

After clicking on "Sales Tax," you will see the tax "Reports" tab which contains the sales tax reporting:

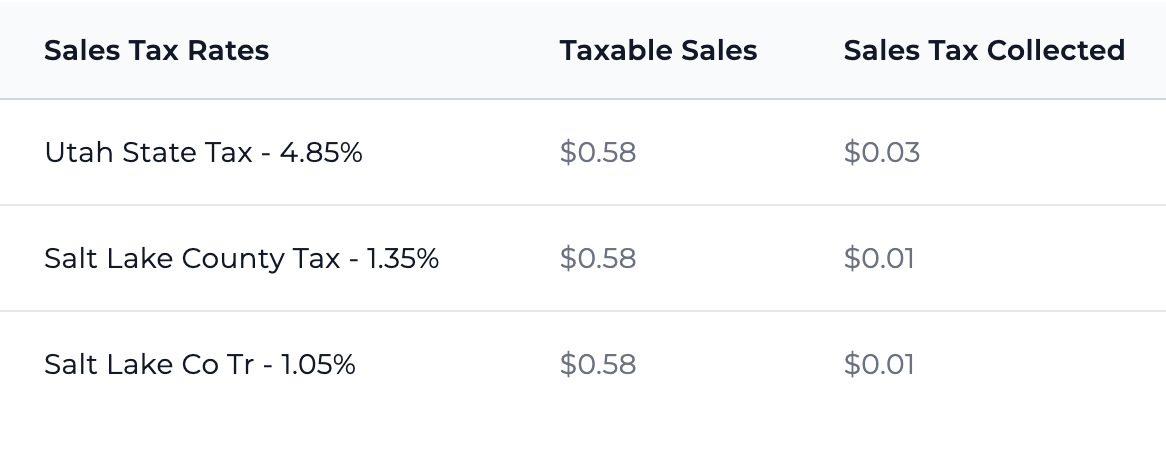

Here you will be able to select a month and a jurisdiction (in the example above, the month is "January 2024" and the jurisdiction is "AB"). However, some sales tax may not have a jurisdiction and would come under "Uncategorized," which can be found in the jurisdiction dropdown. After selecting a timeframe and a jurisdiction, you will see a listing of tax labels as well as each label's sales tax and taxable revenue for the time period as shown below:

One thing to note is when sales tax is both collected and withheld (e.g., an order placed via Facebook where the tax is collected and withheld by Facebook), it is excluded from this reporting. This is done to not overstate the amount of taxes due.

If you have any questions, please contact [email protected].