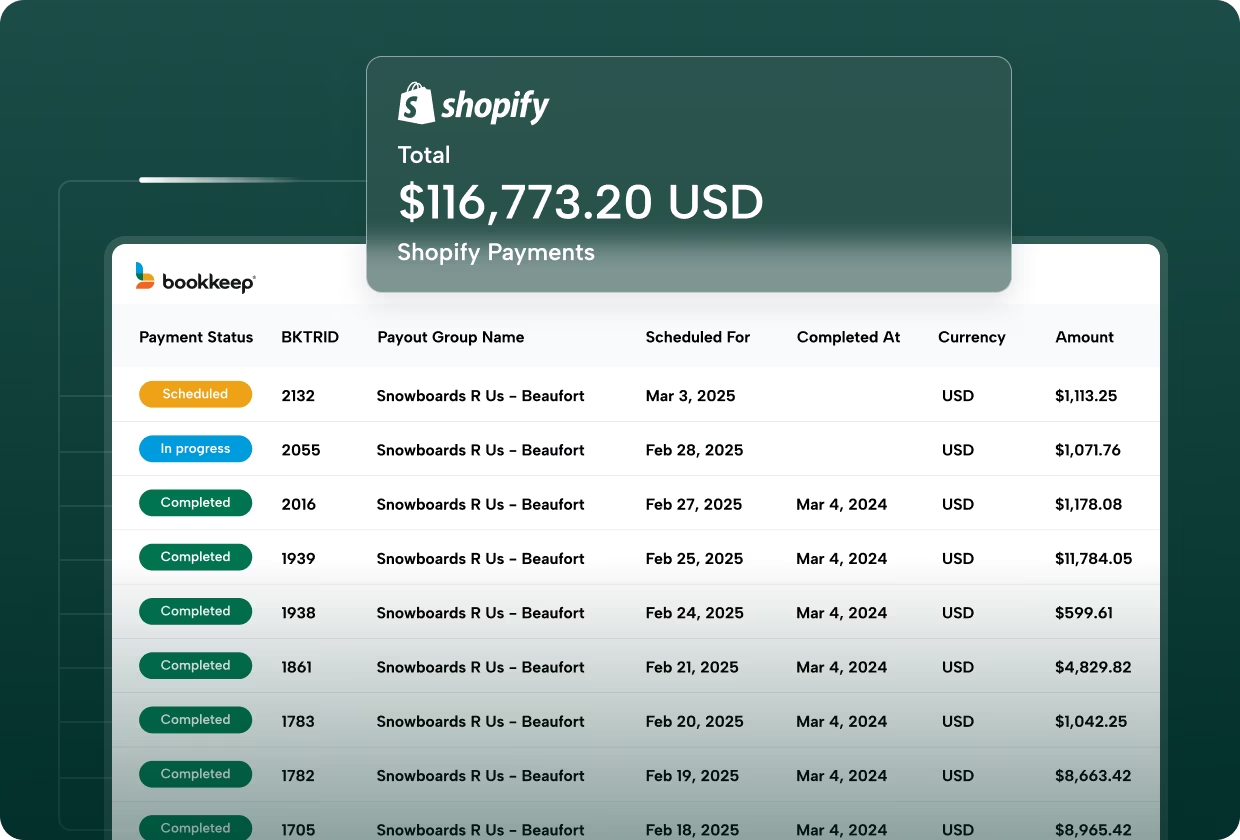

“With Bookkeep, we finally found a reliable and efficient solution to connect Shopify and QuickBooks. Managing the accounting for our franchise network is now streamlined and secure. Today, we have the peace of mind that every transaction is perfectly reconciled and that every cent is properly distributed to our franchisees. Bookkeep has become an essential partner for Shop Santé, and we highly recommend their services to any business looking for accurate and efficient accounting automation.”

“The closing process has gotten so much more simple because of Bookkeep. We now have real-time numbers that I’m confident are right, giving us the ability to do a lot more higher-level analysis, which is better decision-making for the business.”

Brian Thalman

Financial Controller

“I now can take a breath and focus on streamlining procedures, think about the culture I want my company to have, and focus on clients that are better matched for my process… I am now more focused on HR, marketing, and growth. I spend more time on my own company’s financials, which I NEVER did… I also meet with peers, partners, and potential clients in meetings throughout the day, in addition to webinars that I like to participate in.”

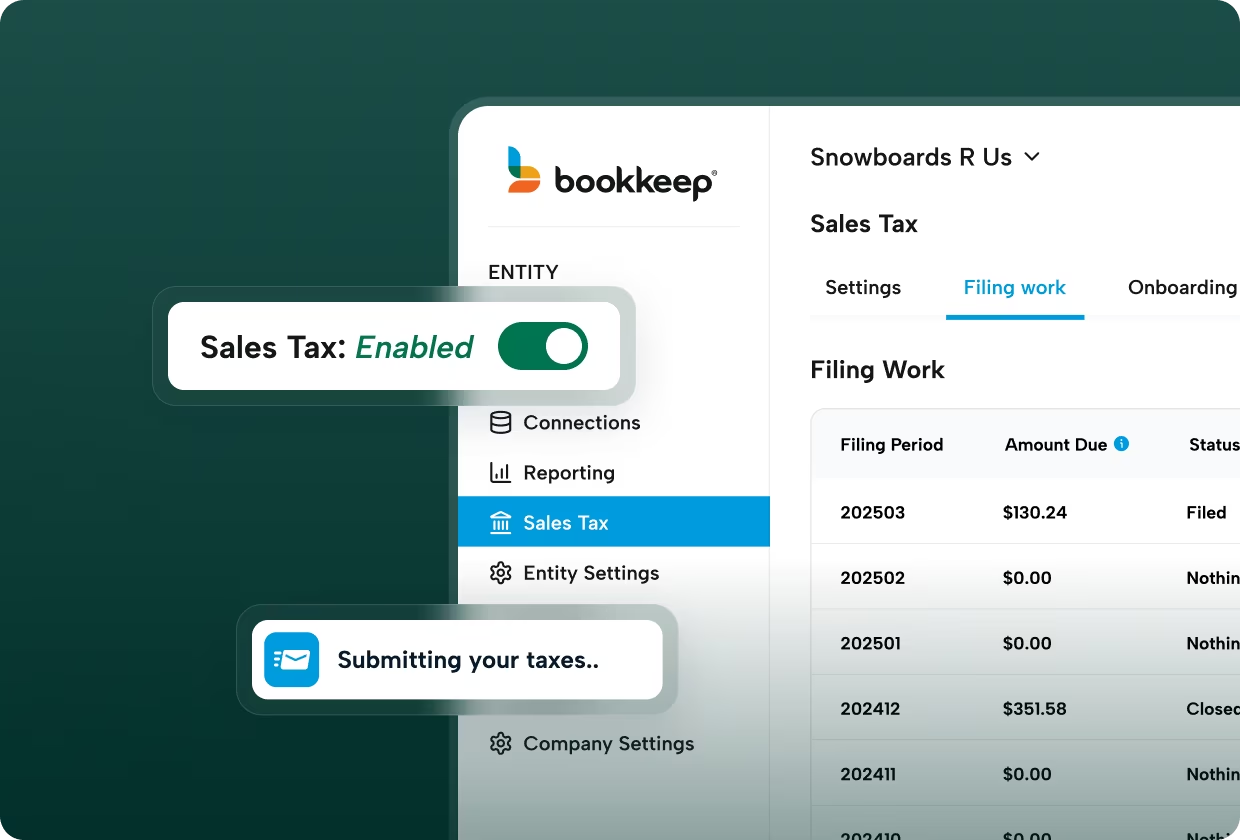

“One of the things I really love about Bookkeep is its compliance area. I can find everything quickly and can see exactly how the entries are calculated and booked, since it’s linked to platforms like Square or Shopify. I have no worries if there is ever an audit… No one else does this. Bookkeep works so well, I forget I’m using it!”

Sherri-Lee Mathers

CPB, AIA

“I would just simply recommend Bookkeep because of the confidence that it gives when your transactions are posted and it tells me to expect a payment and then the payment comes in that, that boosts my confidence. I’ve never been able to reconcile the clearing accounts and I would like to be able to do that and we’re closer now than we’ve ever been.”

Forrest Allen

Head of Accounting

“All of my e-commerce clients are now on Bookkeep. Bookkeep allows me to provide transparent reports that match the sales platforms on a daily basis. It allows me the opportunity to move forward at a better speed, growing my business efficiently.”

“Bookkeep has saved me hours of time dealing with our clients accepting payments from Square, Shopify, Amazon, etc. This application allows us to even grab historical data as we are wrapping up client books for tax prep. The support is superior. This is a must have tool for every accounting professional.”

Dawn Brolin

CPA, CFE, Owner

“My time is worth something. The free time Bookkeep is giving me is more than worth it. By saving a lot of hours each month with Bookkeep, I can work on important things. It’s an investment, not an expense.”

%201.avif)