This article will explain how Bookkeep handles Square Capital Loan repayments and best practices for recording the initial loan disbursement.

Square users have access to Square Loans where a fixed percentage of their daily card sales is automatically deducted until the loan is fully repaid. If sales are up one day, you pay more; if you have a slow day, you pay less.

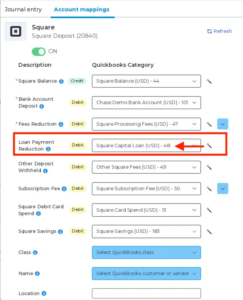

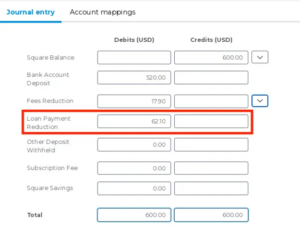

Bookkeep captures any withholdings from your Square Payouts made for repayments towards your outstanding Square Capital Loan on our Square Deposit Journal Entry.

An example Square Deposit would look like below, and if mapped correctly it would reduce your outstanding Square Capital Loan balance.

What becomes more complex and maybe a little confusing is how to record the initial disbursement of funds received from Square as this data is not part of our automation as it does not relate to sales or payments processed by Square, until repayments start.

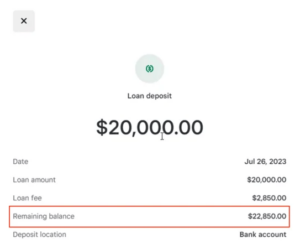

After loan approval from Square you will receive the funds in your designated bank account BUT you will receive the proceeds NET of the financing fee that Square will keep upfront. Recording just the amount received as Square Capital Loan would be incomplete as it would not reflect the correct outstanding balance in your books.

As an example: you receive $20,000.00 from Square and they kept $2,850.00 as financing fee. Your Balance Sheet should show $22,850.00 as the outstanding balance for your Square Capital Loan.

The correct entry for recording this transaction would be:

Note 1: You might want to record the upfront financing fee as Prepaid Interest and expense it across multiple accounting periods but keep in mind that due to the nature of Square Loans (i.e. they can be repaid in 2 years or in 2 weeks as they depend on sales) it can be harder to estimate the duration of the loan.

Note 2: More complexity can came into play when you apply for a NEW Square Capital Loan while you already have an outstanding one, in which case the new funds will be net of the NEW financing fee and the entire outstanding balance of the previous loan.