A balance is an amount in an asset account. So, if you think about your bank account, it has a balance at any given time. A Bank type account in QuickBooks or Xero is a balance account.

Now, let’s take that thinking to Square. You transact using Square in your retail or restaurant and a balance is accrued. You have a balance with Square and you should think about that balance just like you do with your bank account balance.

Key Concept: Each balance must be its own account in QuickBooks or Xero. You would never combine 2 bank accounts into one account in QuickBooks, would you? Ok, so the key concept is ONE BALANCE ACCOUNT PER BALANCE.

You might ask, “Why are you telling me this? Of course, I would never do that.” Well, here is where this happens a lot: Say you have 3 restaurants and each has a Square location; would you combine all those into one account in QuickBooks? No, you should not because we cannot reconcile sales to payments if you combine them into a single balance account.

The key thing to remember is to set up one balance account for each regular deposit you get. So, if you have 2 Amazon Seller accounts, each will deposit separately and, therefore, each needs its own Balance account.

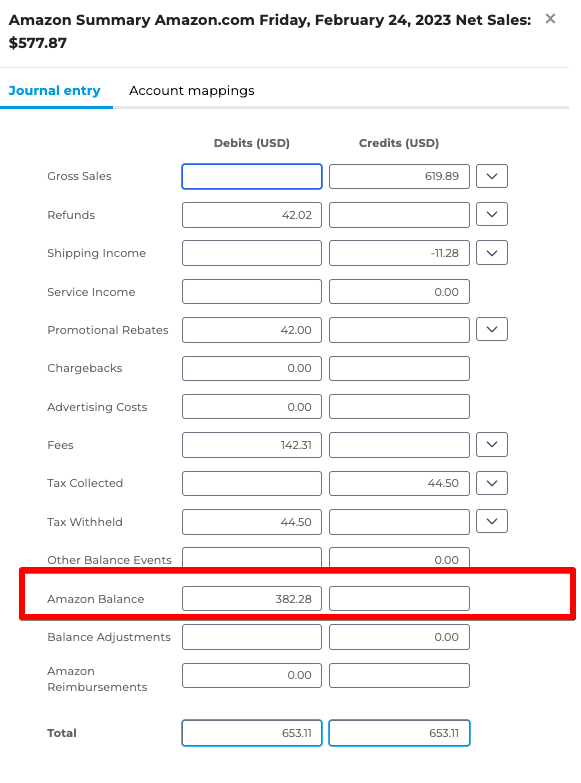

Journal Entry Example:

Common journal entries we perform include both sales and deposits on a daily basis. We book your sales from the prior day which may contain a number of tender types e.g. Stripe, Square, Shopify, etc. Additionally, we capture any deposits coming to your bank account related to those sales.

Amazon Seller is a marketplace and you accrue a balance as you sell. Here, we book your sales for the day against the balance account mapped to the line “Amazon Balance”. In subsequent postings, we will reduce the balance account when Amazon transfers the balance to your bank checking account.

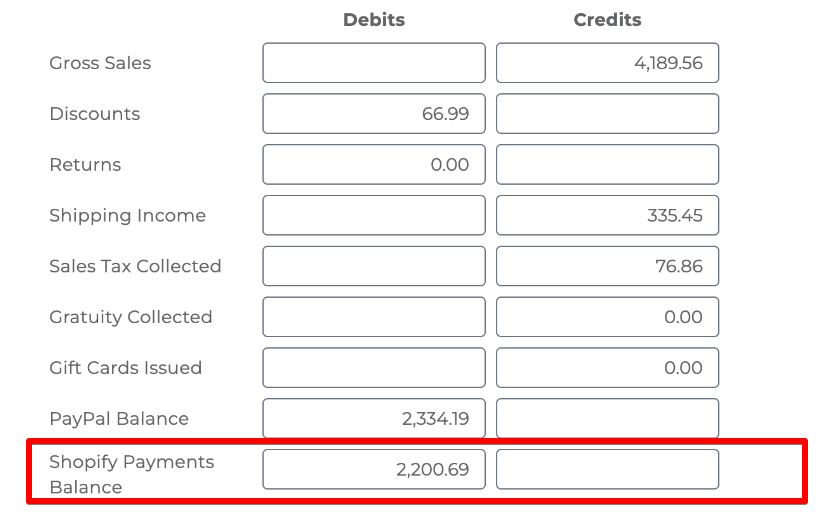

In this Shopify Summary example below, this customer completed sales that were processed by PayPal and Shopify.

Since Shopify is acting as a Sales Platform and a Payment Platform we book the increase in the Shopify Balance.

For PayPal, we use an Inter-App clearing account to track what Shopify says was transacted on PayPal against what PayPal says.

As these sales occur, the balances in their Shopify and PayPal Inter-App clearing accounts are increasing. This is similar to an expected deposit. However, you may choose to keep this balance with Shopify or Paypal (meaning you don’t get it deposited to your checking account) which is essentially acting as a bank account.

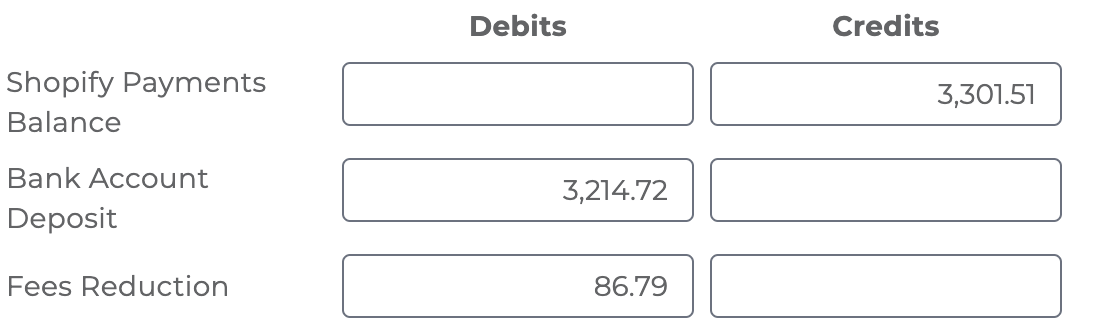

As your balance account increases, you may choose to transfer (or it happens automatically) some of this balance to your bank account which results in a deposit journal entry as shown below. In the example below, Shopify is also taking out some fees which reduce the actual amount hitting your bank account. As you can see the Shopify balance account is being reduced as money deposits to your bank.

As you can see, balance accounts are becoming more common with the many sales platforms and payment platforms used by retailers and ecommerce sellers. As sales occur, the balance account increases and, with each deposit to your bank, the balance account decreases. With the linkage between the two, we definitely recommend mapping the balance account in the sales and deposit journal entry templates to the same account to ensure the increase and decrease between sales and deposits is easily reconciled.