This “adventure in ecommerce accounting” is a DOOZY. And it’s a surprisingly common issue. It arises when your team adds an app or additional selling channel that creates orders in (or imports orders into) Shopify, but the sales generated on that channel are not shown separately in your Shopify Finance Summary.

Take Loop Returns, as an example. It’s a popular Shopify integration for a reason. Your customers get a delightful return experience, your sales may even get a boost due to incentives that are given to the customer to buy more from you even as they are returning products, and it’s eco-friendly to boot. Customers don’t even need a printer because they can use a barcode to mail the item back at their local post office! So much to love about Loop Returns.

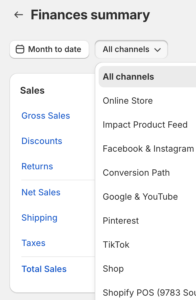

The challenge is that Shopify does not show these additional apps or channels in the Shopify Finance Summary as its own channel (see image below). Additionally, we couldn’t find any documentation on Shopify’s help center to show you how to account for Loop Returns. Therefore, the process to account for these returns and the subsequent “in return flow” upsells will be manual.

To track the Loop Returns sales and sales tax, you’ll need to create a detailed spreadsheet to track the daily totals and ensure you are booking the returns and re-orders properly as part of your revenue accounting.

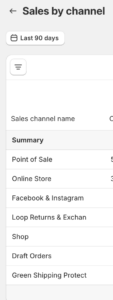

First, pull the Shopify Sales By Channel report (see image below – note this was taken from the same Shopify company as in the image above), and transfer each day’s sales, returns, discounts and sales tax refunded &/or collected to your spreadsheet,

You’ll then need to adjust your Shopify Summary Financials general entry calculation to accommodate the Loop Returns data. There are a lot of moving parts here, so pay special attention to tying each day’s sales out to avoid errors.

Be sure to add a special watch-out for net Sales Tax refunded to customers via Loop Returns, because sales tax on a returned item should be backed out of the amount your company owes (something that Shopify does not do automatically.)

The alternative to this is to use sophisticated ecommerce accounting automation software like Bookkeep. Because we calculate our daily sales Journal Entries based on the sales order data, we can identify all apps and channels to allow you to segment. For example, we are able to show Loop sales channel data in Bookkeep that does not show anywhere in the Shopify Finance Summary reporting sales channels.

We also do this with other apps that import or create orders in Shopify, but do not appear in the sales channels list in the finance summary, and we are able to segment them accordingly for you.

If you would like to see how Bookkeep can help you achieve greater transparency and accuracy and fully automate the accounting for your multi-channel sales, sales tax and returns, please get in touch.