As a business owner, you may choose to do your own bookkeeping or hire a professional bookkeeper. Either way, knowing the basics of bookkeeping will help you better understand the economics of your business and make sure your business is on the right track. Let’s go through some of these bookkeeping basics.

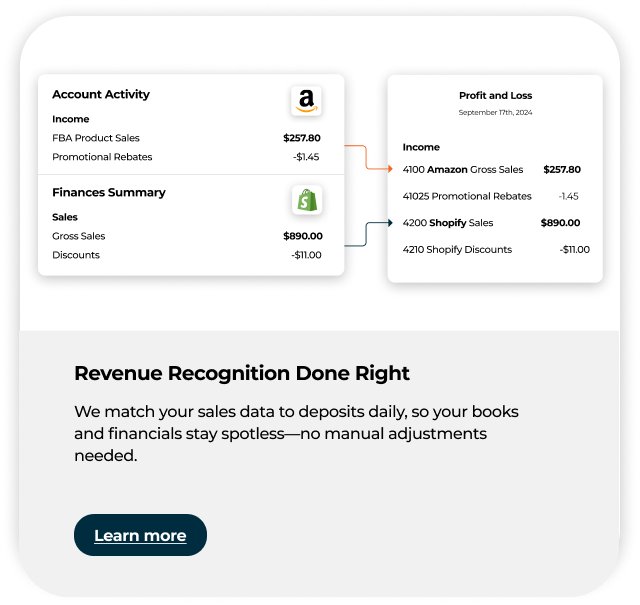

Profit and Loss Statement

A Profit and Loss statement (also known as P&L) shows the revenues and expenses of a business in the simplest terms.

Revenues

Revenues are what customers pay for products and services. Expenses are generally put into two categories: Cost of Good Sold (or COGS) and Operating Expenses.

Cost of Goods Sold

Cost of Goods Sold is the cost of the products you are selling, such as manufacturing costs, materials and packaging costs that go into the finished product, or wholesale price that you paid for the products.

Credit card processing fees can also be included in COGS, although some people choose to include them in operating costs. There are two ways to categorize them. Here are the pros and cons of each when accounting for credit card processing fees. If you use QuickBooks merchant services inside QuickBooks to accept credit card payments, QuickBooks will enter this for you automatically.

Operating Expenses

Operating expenses are all the expenses that go into running a business, including but are not limited to advertising, rent, payroll, utilities, software services, shipping costs to customers, and accounting fees.

Net Income

The net income or loss is what the business generates after expenses are deducted from revenues. Finally, don’t forget about taxes. If the business generates a profit, there will be income taxes. Some states require you to pay a minimum tax or franchise tax at the state level even if you don’t make a profit.

Balance Sheet

The balance sheet contains these three categories:

- What the business owns, these are called assets.

- What it owes are called liabilities.

- Equity of the business owners.

Assets

A business’s assets are everything it owns, including tangible and intangible assets. Intangible assets include royalties and goodwill, whereas tangible assets include:

- Cash – This includes actual cash on hand, in the safe or in the register, bank accounts, other places where your funds are being held, such as Shopify, Amazon, Paypal, and Stripe.

- Accounts Receivable – This is what the customers owe you when you make a sale, but the proceeds are paid at a later date.

- Fixed Assets – These are physical assets that the business owns, such as buildings, furniture, store build-outs (often called leasehold improvements), computers, equipment, and machinery. Some people also choose to put software and domain names purchased in this category if they are significant, which can then be depreciated over time.

Liabilities

A business’s liabilities are what it owes. This includes both short-term and long-term debts such as:

- Accounts Payable – These are what you owe the vendors and suppliers.

- Credit Cards – These are balances on the business’ credit card accounts.

- Tips – Tips collected, especially restaurants, do not belong to you. They belong to the employees and should be paid out as part of their payroll. Do not record tips you collected as part of sales or revenues.

- Gift Cards – When a gift card is sold, it becomes a liability since the customer will redeem it in the future for goods or services. Do not book this as a sale. It becomes a sale when it is redeemed.

- Loans Payable – These are money you borrowed that you will need to pay back. Loans can be from business owners, friends, family, financial institutions, or government institutions such as the SBA.

- Sales Tax Payable – This is sales taxes that you collected on the government’s behalf. This money does not belong to you and should not be used to pay business expenses. It should be set aside in a separate account until you remit it with the sales tax return.

Bookkeeping Basics: How to do Reconciliations

One of the key functions of bookkeeping is bank reconciliations. Reconciliation ensures that all transactions between the books and the bank statements are correctly accounted for.

Accounting software such as QuickBooks can help you accomplish this task easily. To fully utilize the QuickBooks reconciliation feature, you must connect your bank accounts to QuickBooks in the banking section. This way, the bank transaction can be downloaded automatically. After categorizing all the transactions from the banking feed, month-end reconciliation should be a breeze.

When you master the bookkeeping basics above, you will be well on your way to understanding your financials. Having a clear focus on your financials is a crucial factor to long-term success for your business.