Shopify and PayPal play so nicely together. Or, do they? The short answer is “Yes, they do”, but the longer more nuanced answer is that companies that use them together need to be aware of a very real risk of double-booking the sales revenue, and possibly the PayPal payouts as well, under certain circumstances.

On their own they are exceptionally powerful platforms and while each can present challenges to the accounting teams who must book the revenues, sales tax, discounts, returns, and more, when BOTH are used within the same business (and on the same order in Shopify), there are some key things to know in order to ensure your revenues and cash are not overstated in your accounting system

Shopify (along with Amazon, WooCommerce, and BigCommerce to name a few) is predominantly a selling platform and PayPal is predominantly a payments platform, but each will attempt to report the sales that are run through their platform, if connected directly to the accounting system (think QuickBooks Online, Xero, Sage Intacct, or Zoho Books). This presents a very real challenge for accounting teams and business owners alike.

The solution is to use an Inter-App Clearing Account when booking the daily sales and payouts entries from each platform.

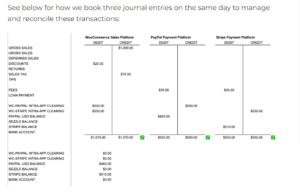

In the example shown below, the business is using WooCommerce as the selling platform, and PayPal and Stripe as the payment platforms. (Note the process is the same for Shopify, or Amazon, but becomes more complex if you are using more than one selling platform.)

Following the example below, three journal entries are needed in order to properly book the WooCommerce sales and corresponding expected payouts from PayPal and Stripe, and not find yourself in a double-entry situation for either sales or cash. Note that you must calculate and post all three entries for each day that you generate sales, and all three entries are posted at the same time to your accounting system.

Your Inter-app clearing accounts should net out to zero once all three journal entries are posted. If not, you’ll need to check your numbers and ensure you picked them up correctly from your selling and payment platform reports.

Your P&L will reflect the Sales, Discounts, Returns, Sales Tax, etc generated by WooCommerce, and you’ll see a debit balance in the PayPal Balance Account (Asset), and the Stripe Balance Account (Asset). This is because those platforms will not remit the deposits until a few days later, so the Balance accounts are effectively receivables at the time you book the sales entries. Once you receive the payouts, you will make an additional set of entries that will Debit cash, and Credit the respective balance accounts, for the amounts you received from PayPal and Stripe.

Because it is easy to neglect a day’s worth of entries, or to skip the second half of the entries needed when the payouts occur, it is advisable to have a written process and a checklist to follow.

An alternate way to accomplish this is to use an accounting automation app like Bookkeep. Inter-app clearing accounts are something we can help you set up, and once each selling and payment app is mapped to the GL, the entries will just flow automatically each day while you sleep. Its a real game-changer that will not only save your accounting teams a lot of time, but also frustration as well.

For more information, please book a brief call or take a free trial at https://www.bookkeep.com/