What is Inter-App Reconciliation?

Navigating the Complexity of Ecommerce Accounting

Ecommerce accounting is inherently complex due to the need to manage multiple sales platforms and payment platforms, which often overlap in functionality. For example, PayPal and Stripe can function both as payment platforms and as sales platforms.

Understanding Sales and Payment Platform Interactions

When platforms like PayPal and Stripe are used not only to process payments but also to host sales, the lines between sales and payment platforms blur. This dual functionality requires meticulous reconciliation between the records of sales and payments.

Let's consider a practical scenario:

If you are using WooCommerce as your sales platform it's not uncommon to accept payments through PayPal and Stripe. You're likely familiar with the direct integration for payment processing. However, both PayPal and Stripe also have the capability to host direct sales that aren't necessarily reported in WooCommerce.

The Challenge of Accurate Reconciliation

Reconciliation challenges arise not only from these overlapping roles but also from discrepancies in reporting and time zone differences. For instance, WooCommerce might report $100 collected via PayPal, but verifying that PayPal's records match is crucial due to potential reporting errors or delays.

How Do We Reconcile?

Implementing Inter-App Clearing Accounts

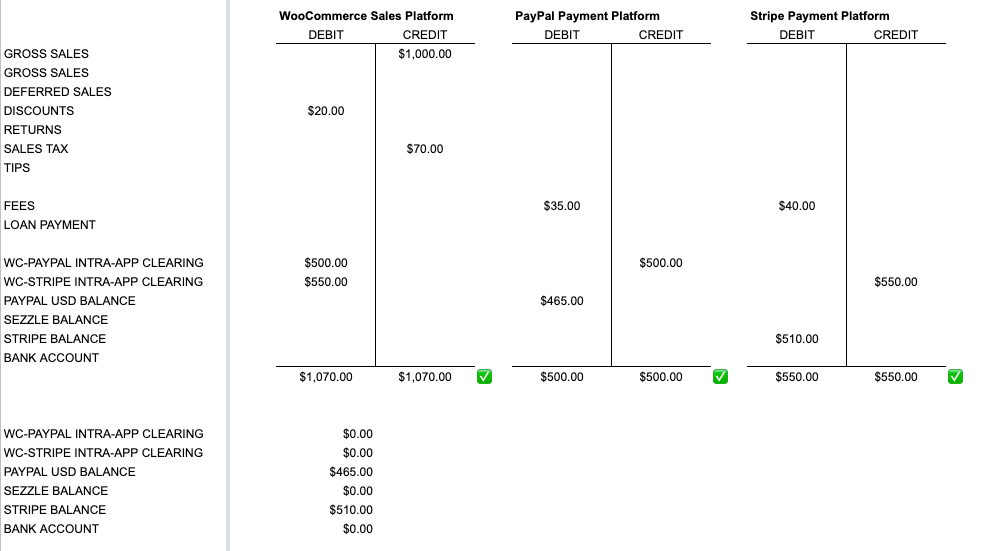

To effectively manage and reconcile these complex relationships, we use Inter-App Clearing Accounts. These differ from a Balance Account because a Balance account represents your balance with that payment platform (e.g., Stripe or PayPal) which is only part of the picture. Inter-App Clearing Accounts are crucial for tracking the flow of transactions across different platforms and should net out to $0, indicating proper reconciliation. Any persistent discrepancy signals an issue needing investigation.

For example, when using WooCommerce with PayPal, you should establish an Other Current Asset type account named WC-PayPal Inter-App Clearing. In your WooCommerce sales summary journal entry, allocate sales processed by PayPal to this account. Subsequently, map the "Express Checkout Payments" from PayPal to the same clearing account to ensure all transactions are accounted for accurately.

See below for how we book three journal entries on the same day to manage and reconcile these transactions: