Automated sales tax compliance for Shopify merchants

Bookkeep handles sales tax from calculation to payment—automatically and accurately—for every Shopify store, location, and sales channel. Also available for Square POS merchants selling in the U.S.

Your entire sales tax process automated—daily and by the book.

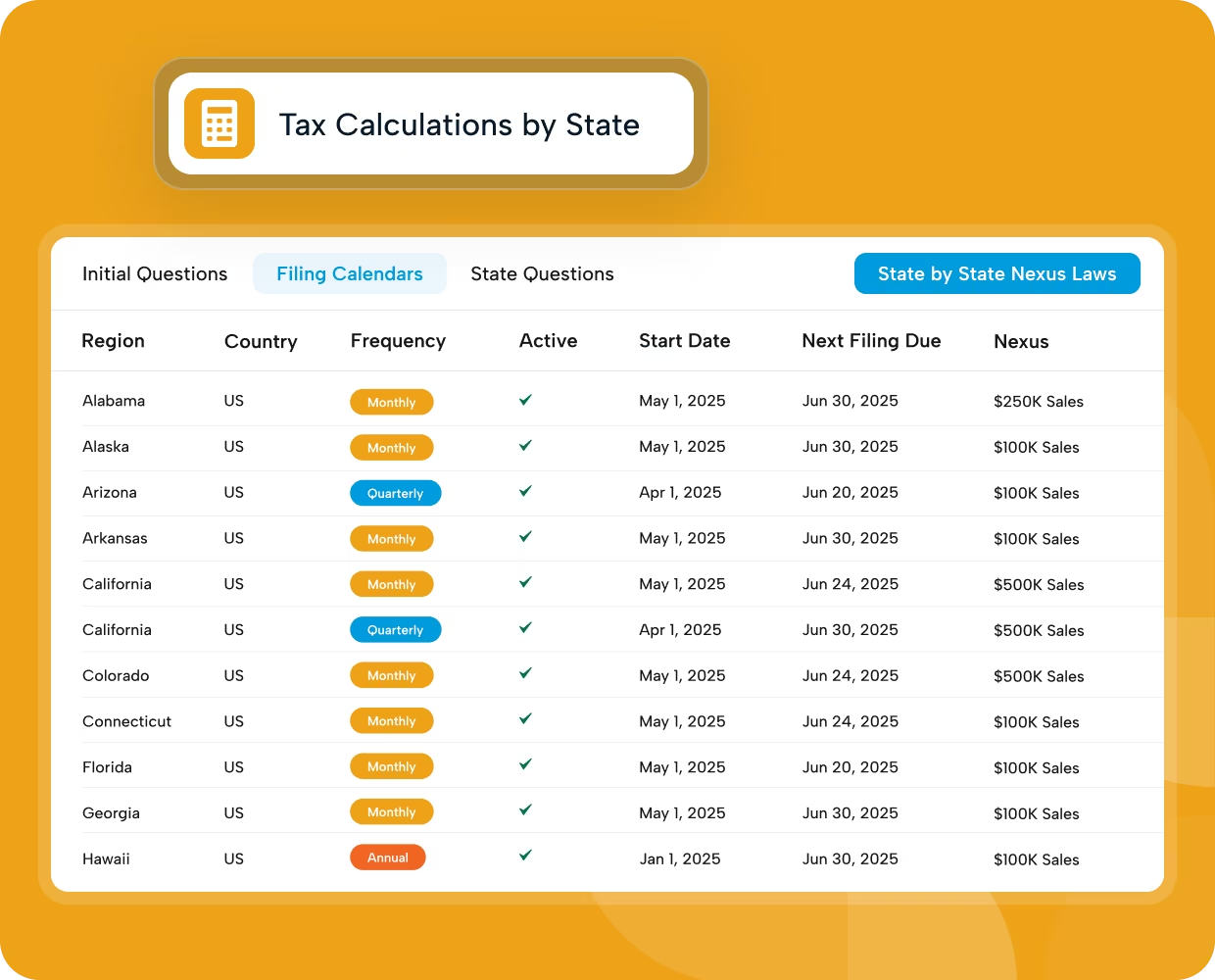

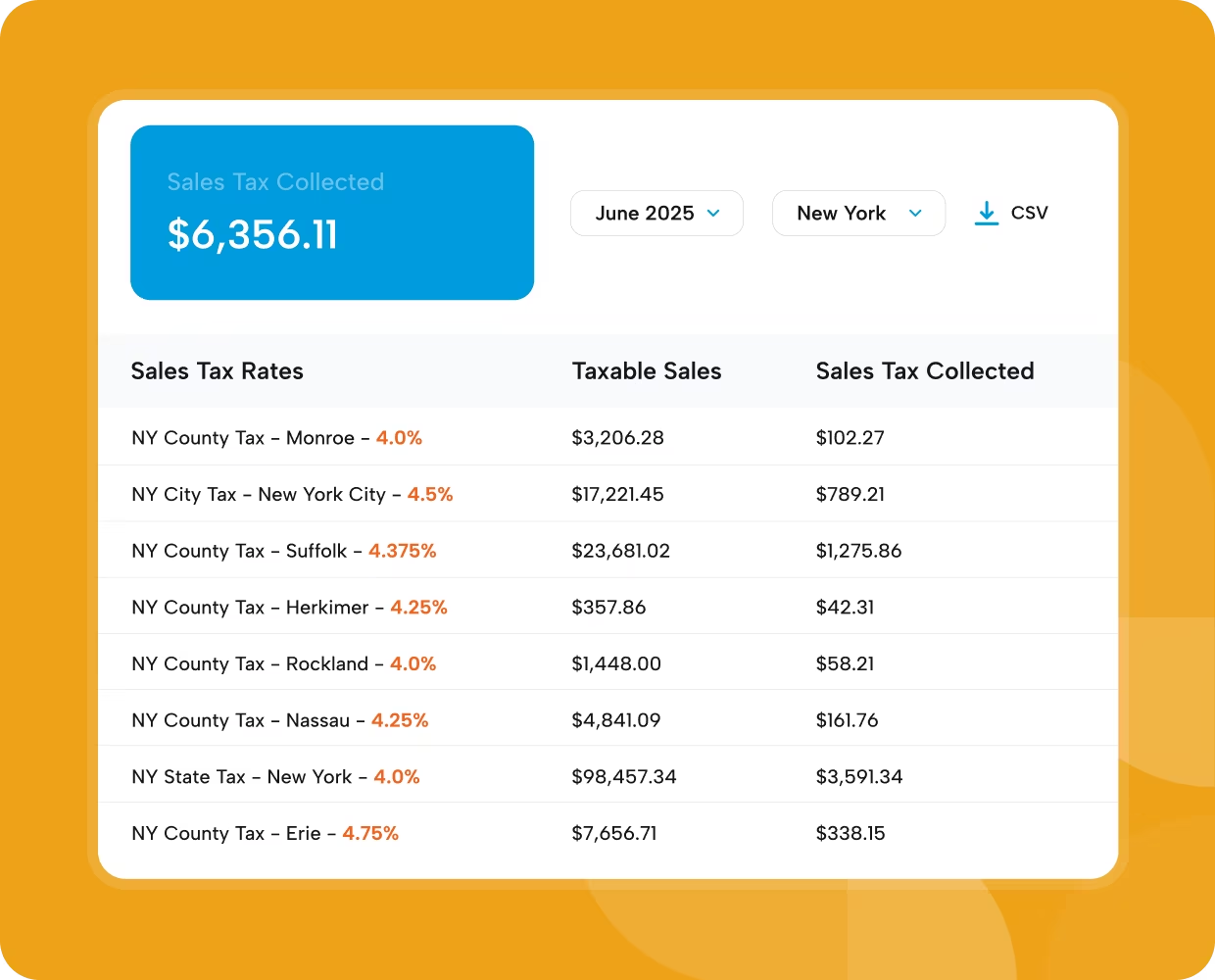

Always Accurate Sales Tax Liability Calculations

Track your sales tax obligations in real time across all your sales channels and physical locations, ensuring nothing slips through the cracks.

By State

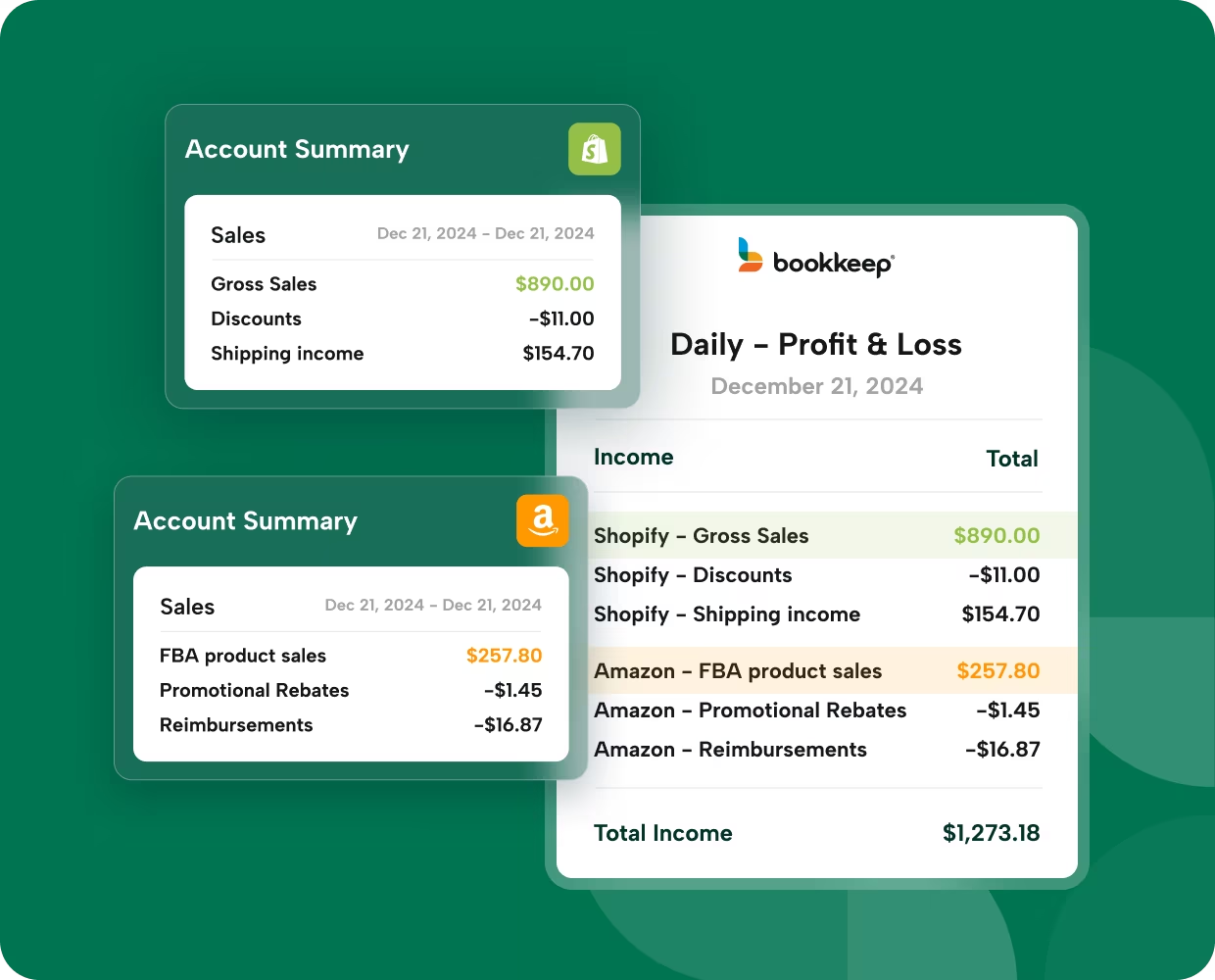

By Sales Channel

By POS location

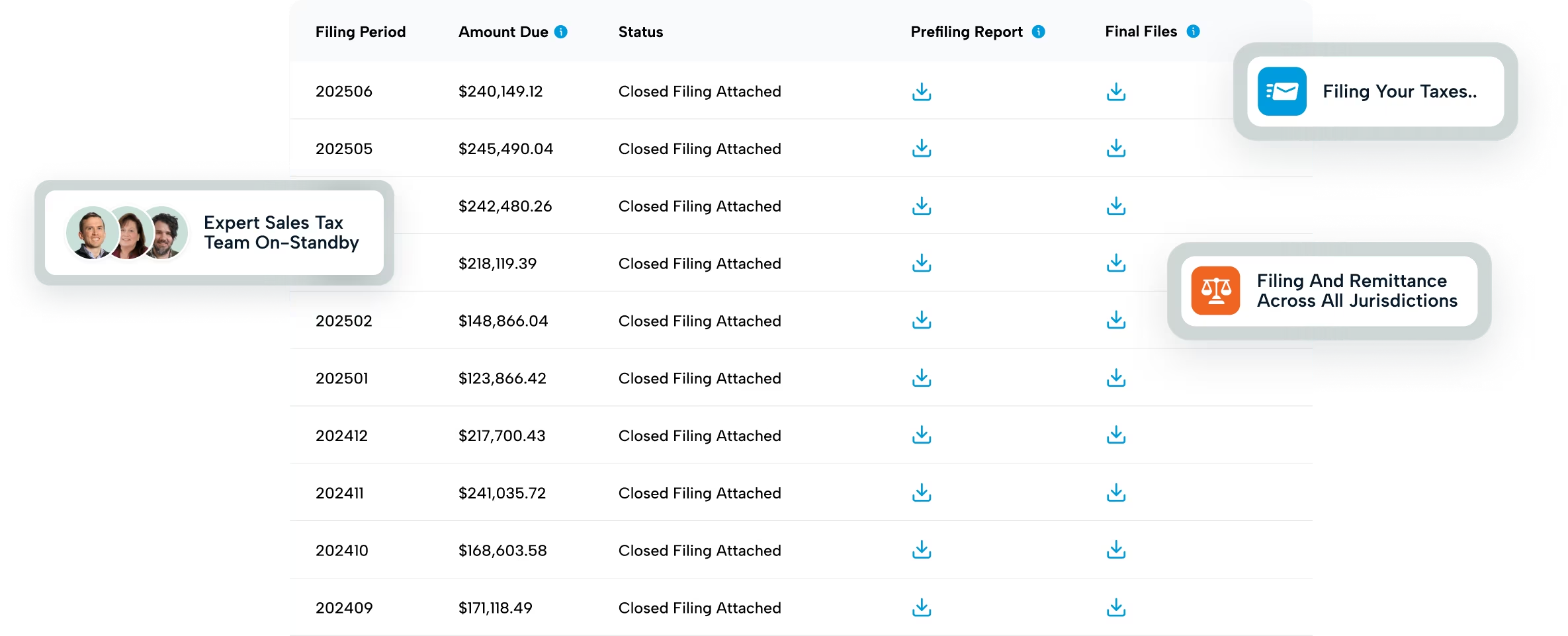

Filing and remittance across jurisdictions, always on time

We handle the complexities of filing and paying taxes across all states and localities, ensuring you stay compliant and avoid penalties.

Accurate filings across states

Payment always on time

100% audit-proof

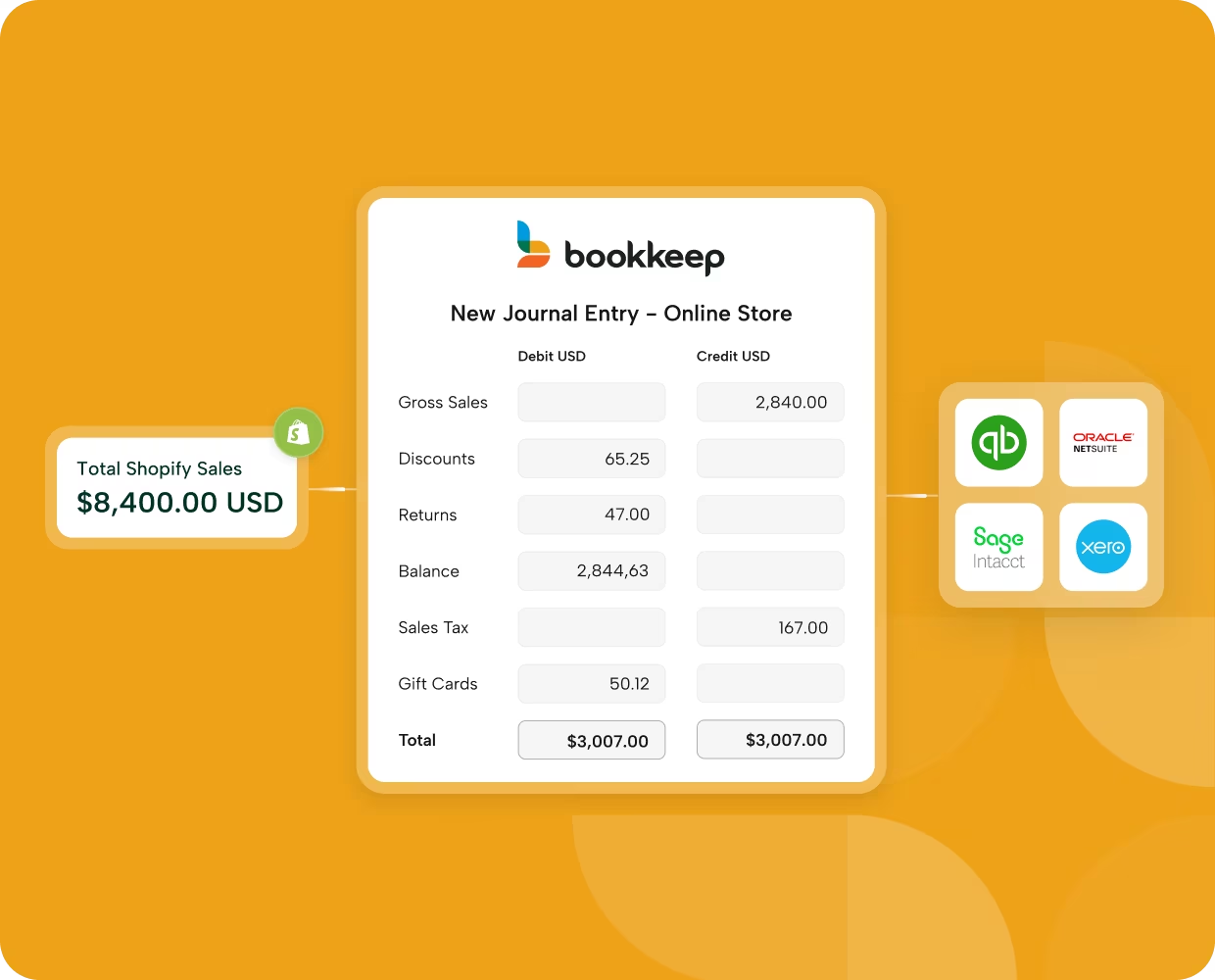

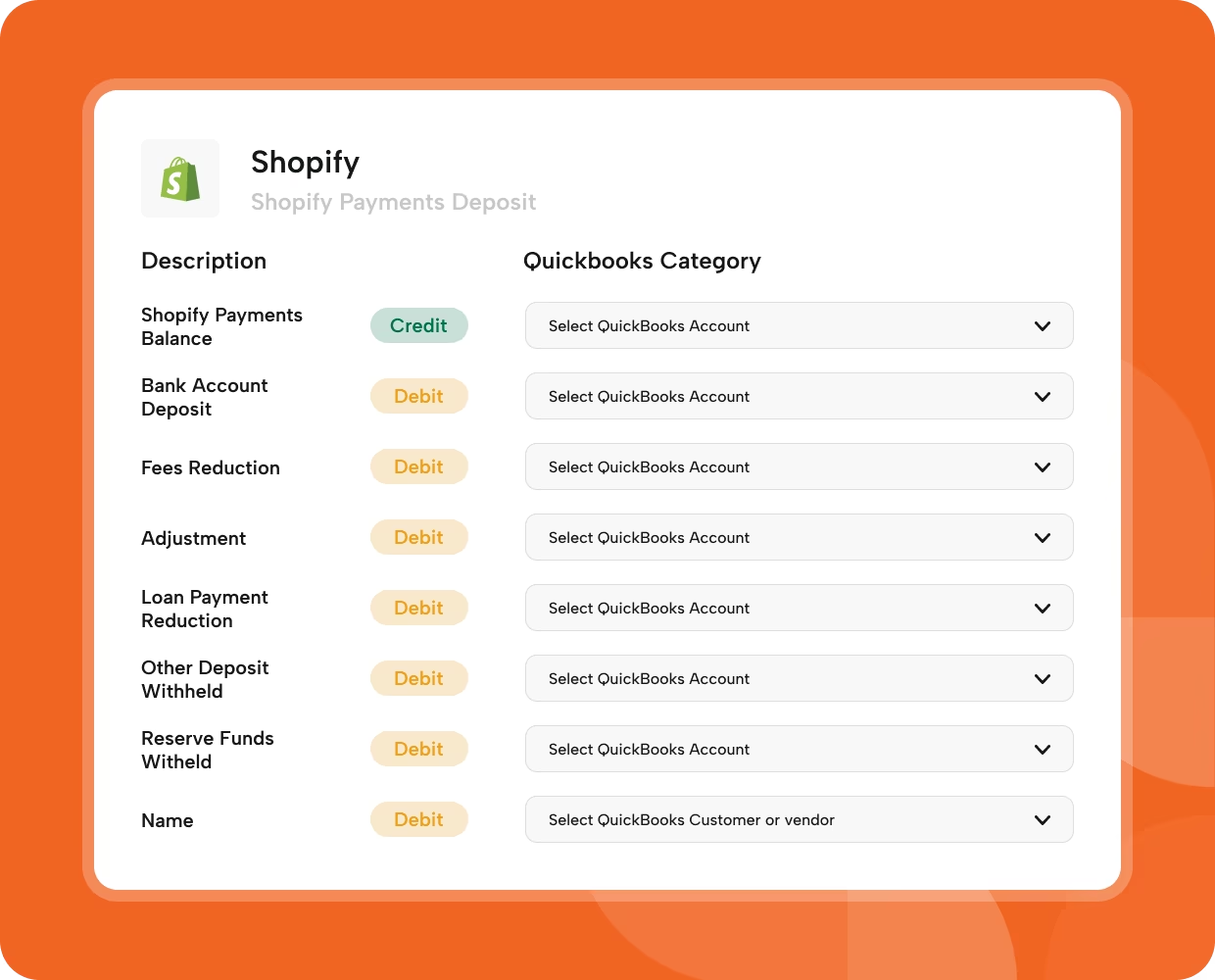

Sales tax journal entries posted directly to your accounting platform

Automated entries eliminate manual data entry, keeping your books accurate and up to date without extra work.

Auto-posted daily entries

Channel-level tax tracking

No manual work

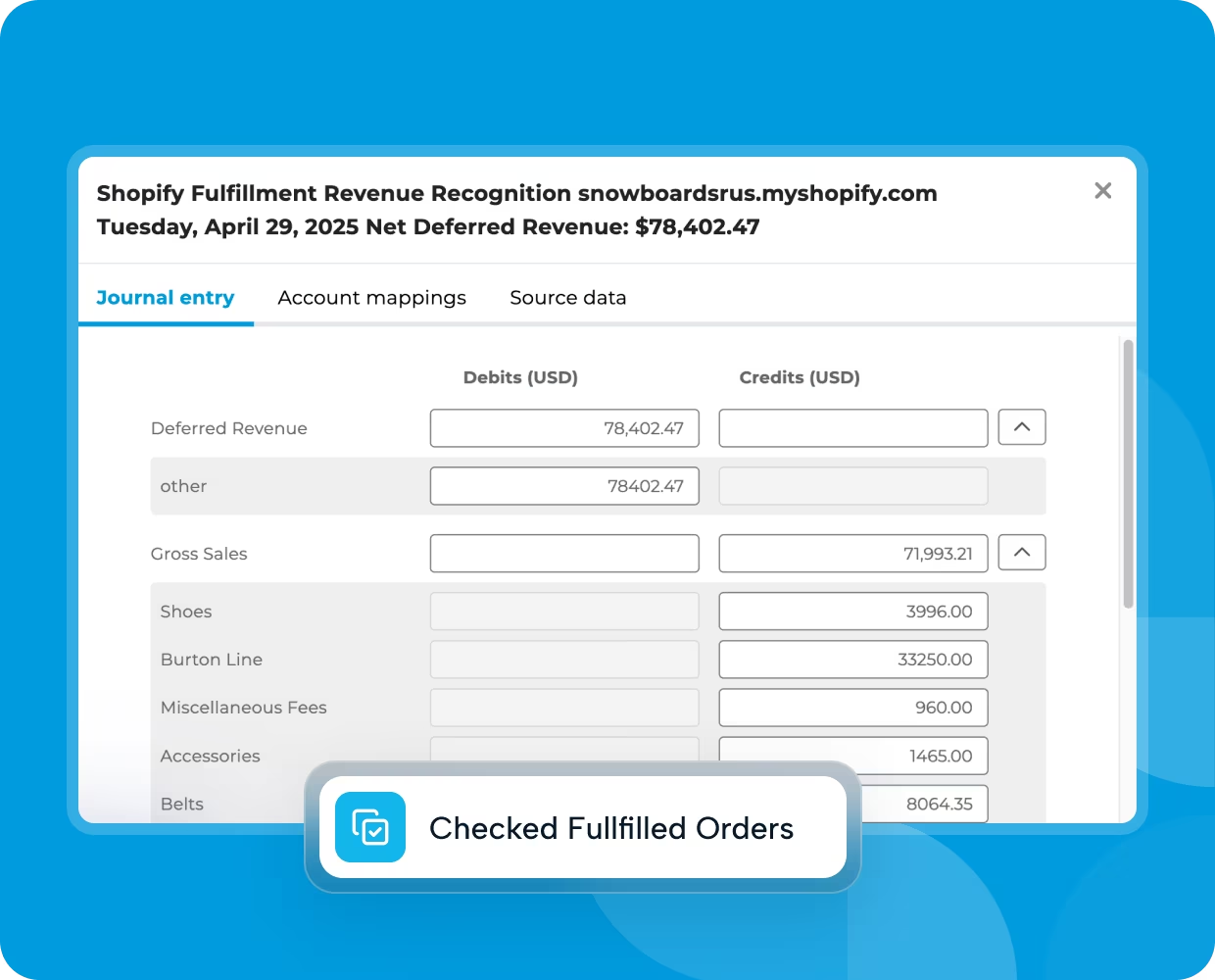

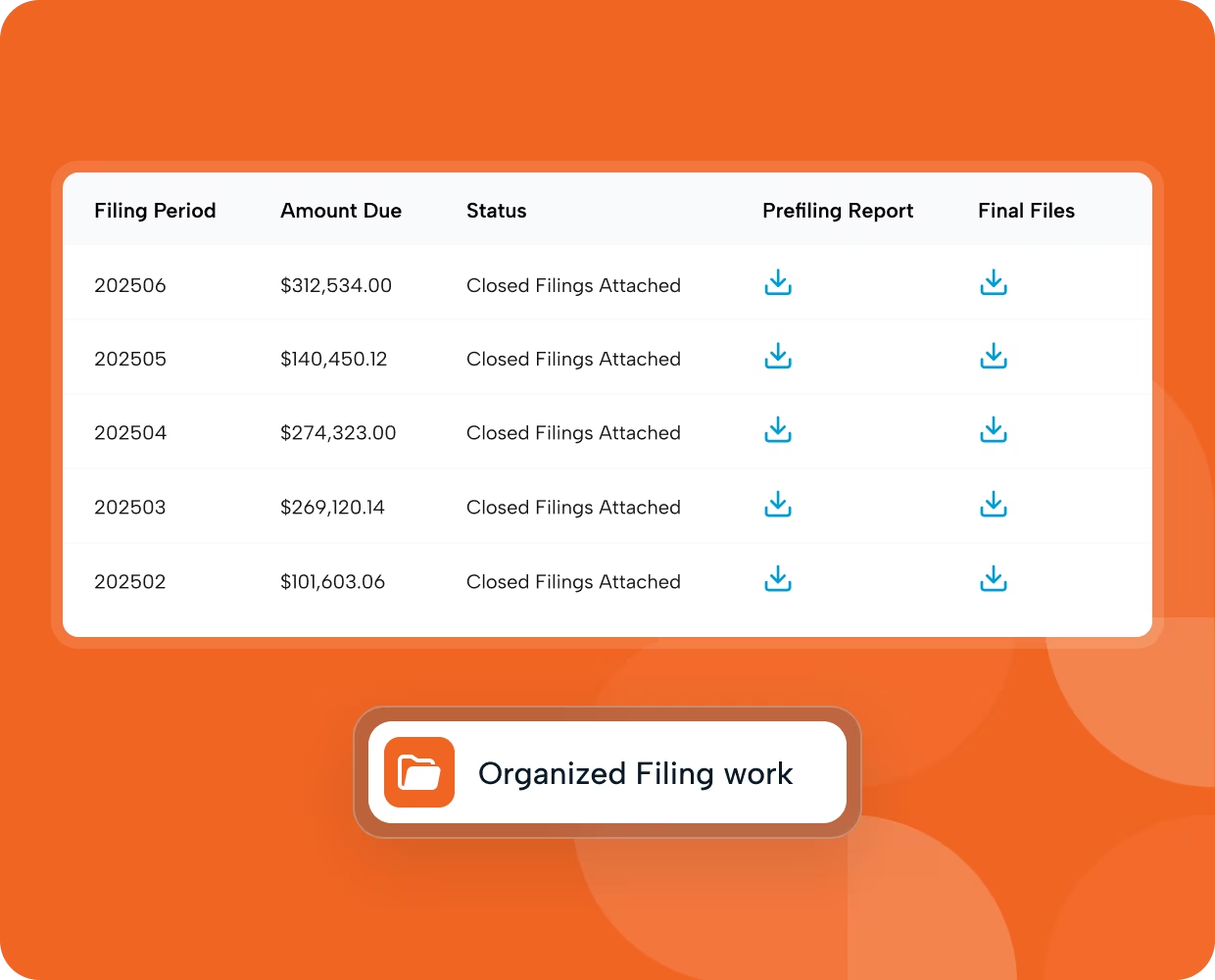

Audit-ready records and reporting by entity

Easily access detailed, organized reports for each business entity, simplifying audits and internal reviews.

Clean liability logs

Exportable audit reports

Marketplace rule compliance

Multi-state and multi-location compliance coverage

Easily access detailed, organized reports for each business entity, simplifying audits and internal reviews.

Clean liability logs

Exportable audit reports

Marketplace rule compliance

Built for the complexity ofreal Shopify businesses

Multi-state ecommerce brands

Accrual-based tax liability tracking and automated filing in every state

Multi-location operations

Accurate, daily location-level tax posting and compliance

Multi-location or franchise businesses

Automate filings per store or per franchisee entity

High-volume merchants

Keep pace with growth using hands-free, daily automation

Our dedicated sales tax team is included within your plan

No ticket queues

No surprise fees