How to Migrate to Bookkeep for Saving Time and Increasing Data Accuracy

As you embark on the migration to Bookkeep, it is essential to follow best practices and tips that we have gathered through assisting customers like yourself.

Migrating to Bookkeep involves connecting your ecommerce and POS apps to your accounting platform, facilitating a seamless flow of financial data and improving bookkeeping accuracy. This integration ensures a comprehensive overview of your business's financial activities and performance.

Initial Mapping to Accounts in Your Accounting Platform

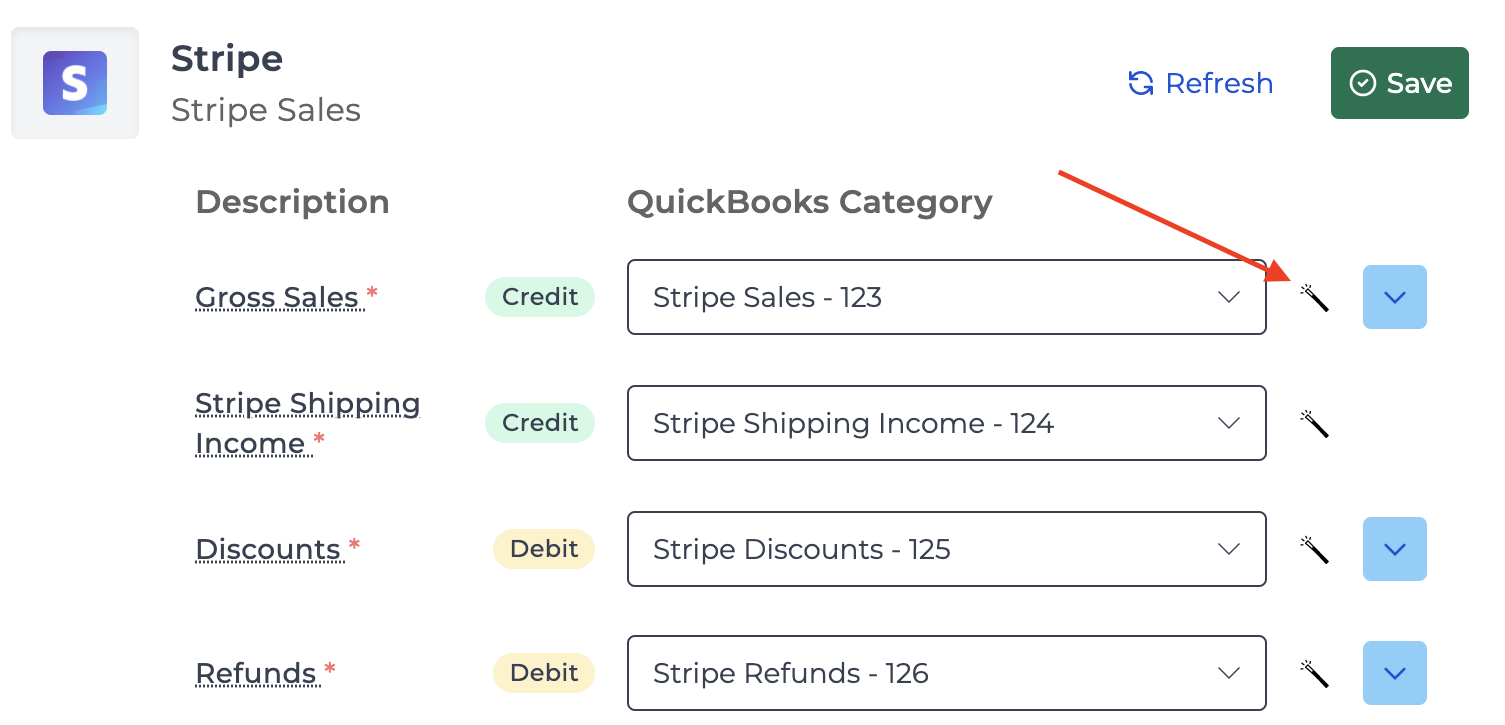

During the initial setup, decide whether to use existing accounts or create new accounts using Bookkeep’s magic wand feature, as shown below.

Creating new accounts can help track entries from your start date with Bookkeep, ensuring all data is accurately categorized. By utilizing the magic wand feature to create accounts, you will automatically generate our recommended accounts with the appropriate account type, such as "Other current assets" for a balance account. This streamlined process ensures that your financial data is accurately categorized and organized, facilitating a smoother transition to Bookkeep.

Managing Previous Balances

Whether you opt for creating new accounts or using existing ones, it's essential to have all financial transactions, including sales and deposits, posted up to the transition date. For instance, if you begin recording sales with Bookkeep on January 21, ensure that sales from January 20 and earlier are already accounted for to avoid any missing data.

It is crucial to be mindful of any previous balances in your accounts when transitioning to Bookkeep. For instance, you might have recorded sales before using Bookkeep, but the corresponding deposits may occur after you start using the platform. In such instances, Bookkeep will post the deposit for sales that took place before you began using the platform. To ensure proper reconciliation, make sure to record these sales and deposits that occurred before using Bookkeep before posting any entries. This will help in reconciling any expected deposit amounts when the first deposit occurs with Bookkeep.

Example

- January 20 - sales for $200, and therefore an expected deposit of $200 exists in your balance account in your accounting platform

- January 21 - start using Bookkeep

- Bookkeep records sales and deposits moving ahead

- January 22 - deposit for the $200 posted by Bookkeep

- Prior balance of $200 in expected deposits is reduced to $0 since Bookkeep posted the deposit

Tender Type Accounts

When integrating your apps with Bookkeep, you may encounter various payment tender types like cash, PayPal, or checks. To streamline your bookkeeping process, it is beneficial to create separate accounts for each tender type in your accounting platform. This practice simplifies monthly reconciliation tasks and ensures accuracy in tracking your financial transactions.

We are here to help with your transition to Bookkeep. Each situation can be unique, but overall we recommend having your books up to date when starting with Bookkeep to ensure prior sales and other financial events are already posted to ensure a seamless onboarding experience.

If you need any help, please contact [email protected].