Understanding Payment vs. Sales Differences in Shopify with Bookkeep

Introduction

For Shopify merchants, one of the most common reconciliation challenges is understanding why the total payments collected in a day don’t always match the total sales completed that same day.

These differences are normal — but if not properly categorized, they can lead to reconciliation issues, misstated financials, and frustration during month-end close.

Bookkeep’s Shopify accounting automation eliminates this problem by automatically identifying, categorizing, and tracking the key components that drive these timing and value differences. This article explains what causes the gap between payments and sales, how Bookkeep accounts for it, and how this improves financial accuracy and efficiency.

Why Payments and Sales Rarely Match

Before exploring how Bookkeep resolves these discrepancies, it’s important to understand why they happen. Differences between daily payments and sales usually stem from three main categories:

1. Accounts Receivable (A/R) Activity

Shopify supports transactions that create or settle receivables, including:

-

Creation of A/R: Orders placed but not yet paid (e.g., manual payment methods, partial payments, or net terms).

-

Settlement of A/R: Payments collected on previously unpaid or partially paid orders.

-

Refunds against A/R: Refunds issued on orders not fully paid.

2. Exchange Rate Differences

Merchants selling in multiple currencies experience foreign exchange impacts:

-

Currency Conversion: Shopify converts customer payments in foreign currencies to the shop’s base currency — especially common for Managed Markets orders.

-

Rounding Variances: Minor rounding adjustments occur during currency conversions.

-

Multiple Payments per Order: When multiple payments in different currencies are applied to one order, varying exchange rates can create larger cumulative gains or losses.

3. Orders Marked as Paid Without Recorded Payments

Orders can appear as “paid” in Shopify without an actual payment transaction in several cases:

-

Manual Overrides: Staff manually marking orders as paid.

-

POS Transactions: In-store sales recorded outside of Shopify Payments.

-

Draft Orders: Converted to paid status without capturing payment.

-

Import or Integration Errors: Missing transaction records during migration or sync.

-

Gifting: Orders given away at no charge but marked as paid.

-

Order Exchanges: Return/exchange platforms like Loop Returns may create replacement orders marked as paid without new payment activity.

How Bookkeep Tracks and Categorizes These Differences

Bookkeep’s Shopify integration automates the entire categorization process, giving you visibility into the sources of every variance between sales and payments.

Daily Sales vs. Payments Breakdown

Each day, Bookkeep generates a sales summary journal entry that summarizes sales and payment activity by payment type. Any differences are automatically booked to the Pending Payments line — a clear signal that timing or classification differences exist.

Example

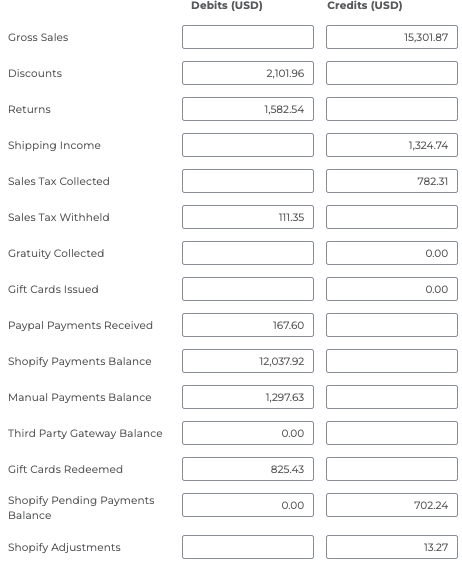

In the example below, Bookkeep identifies a $702.24 difference between daily sales and payments received.

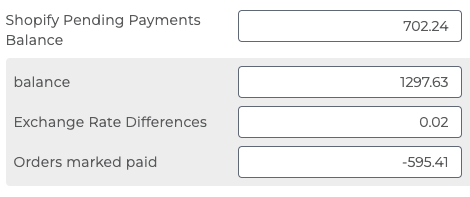

Upon expanding the detail, this $702.24 difference breaks down as:

-

$1,297.63 — creation of accounts receivable (unpaid orders)

-

$0.02 — Exchange rate differences

-

$595.41 — Orders marked paid without recorded payments. This could be due to a variety of reasons as mentioned above including gifting, payments not imported, operational issues, etc.

By separating these components within one daily sales summary, Bookkeep establishes a clear relationship between sales and payments while preserving the data accuracy to understand what is happening within a single sales day.

Accounts Receivable Tracking

Bookkeep automatically:

-

Identifies new receivables from unpaid or partially paid orders

-

Tracks A/R settlements when payments are later collected

-

Posts both creation and settlement under the Pending Payments as "Unpaid orders" and "Order collections" subcategories

Example Journal Entry for A/R Activity

When an order is placed but not paid:

| Debit | Credit | |

|---|---|---|

| Accounts Receivable | $150.00 | |

| Revenue | $136.36 | |

| Sales Tax Payable | $13.64 |

When payment is later received:

| Debit | Credit | |

|---|---|---|

| Shopify Payments Balance | $150.00 | |

| Accounts Receiveable | $150.00 |

Exchange Rate Difference Identification

Bookkeep automatically compares the expected payment (based on shop currency) to the actual amount received after conversion. Any difference is booked as an Exchange Rate Difference under Pending Payments.

Example Journal Entry for Exchange Rate Differences

When payment received is less than expected (exchange loss):

| Debit | Credit | |

|---|---|---|

| Shopify Payments Balance | $148.25 | |

| Exchange Rate Gain/Loss | $1.75 | |

| Gross Sales | $150.00 |

When payment received is more than expected (exchange gain):

| Debit | Credit | |

|---|---|---|

| Shopify Payments Balance | $152.50 | |

| Revenue | $150.00 | |

| Sales Tax Payable | $2.50 |

Payment Discrepancy Detection

Orders marked as paid without actual payment data are posted under the Orders Marked Paid subcategory within Pending Payments.

Example Journal Entry

For orders marked paid without recorded payment:

| Debit | Credit | |

|---|---|---|

| Payment Discrepancy Account (Orders marked paid) | $125.00 | |

| Gross Sales | $125.00 |

Benefits of Bookkeep's Approach

This comprehensive tracking system provides several key benefits:

1. Accurate Financial Reporting

- Clean distinction between sales activity and cash flow

- Proper accounting regardless of payment timing

- Accurate accounts receivable balances

- Transparent tracking of exchange rate impacts on the business

2. Improved Operational Insights

- Pattern detection for recurring discrepancies

- Identification of operational or process issues in order handling

- Visibility into multi-currency impacts on profitability

3. Time Savings

- Elimination of manual tracking and spreadsheets

- Automation of complex currency conversion calculations

- Reduced need for error correction and investigation

- Streamlined month-end close process

Best Practices for Using Bookkeep's Payment vs. Sales Tracking

To maximize the benefits of Bookkeep's automated tracking:

- Use dedicated accounts for exchange rate differences and payment discrepancies.

- Review exception reports regularly to identify recurring operational issues.

- Verify initial setup to ensure Shopify payment and sales mappings align with your chart of accounts.

Conclusion

Differences between Shopify sales and payments are inevitable — driven by receivable timing, exchange rates, and operational processes.

Bookkeep’s Shopify integration turns these variances into transparent, structured data through automated categorization and journaling. The result:

✅ Accurate financial reporting

✅ Faster reconciliations and month-end close

✅ Actionable insights into business operations

For support or further guidance, contact [email protected].