Journal Entry Lines: Categories versus Subcategories

Introduction to Journal Entry Mapping

When integrating your e-commerce platform, such as Shopify, with your accounting software, it's essential to correctly map journal entry lines. This initial setup is crucial as it ensures that all financial data seamlessly transitions into your accounting platform, maintaining both accuracy and compliance.

Categories: The Basics

Categories in journal entries serve as the primary classification of transactions. Each category captures a specific type of transaction essential for comprehensive financial reporting.

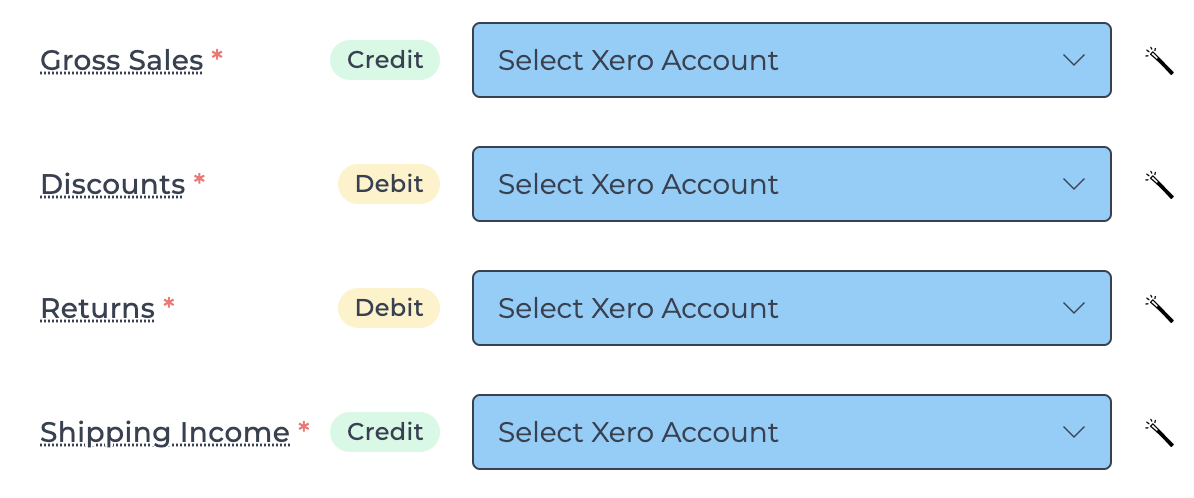

When completing the account mapping to accounting for the first time after connecting accounting and your source system integration (e.g. Shopify) you see what we consider categories e.g. Sales, Discounts, Taxes, Payments, etc. as shown below:

Categories marked with a red asterisk are required to be mapped in order for the entry to post to an accounting platform.

Subcategories: Flexibility and Precision

Subcategories refine the data captured in categories by providing more detailed transaction breakdowns. These are provided by the source system and can be their standard subcategories or specific to your account, and they change over time.

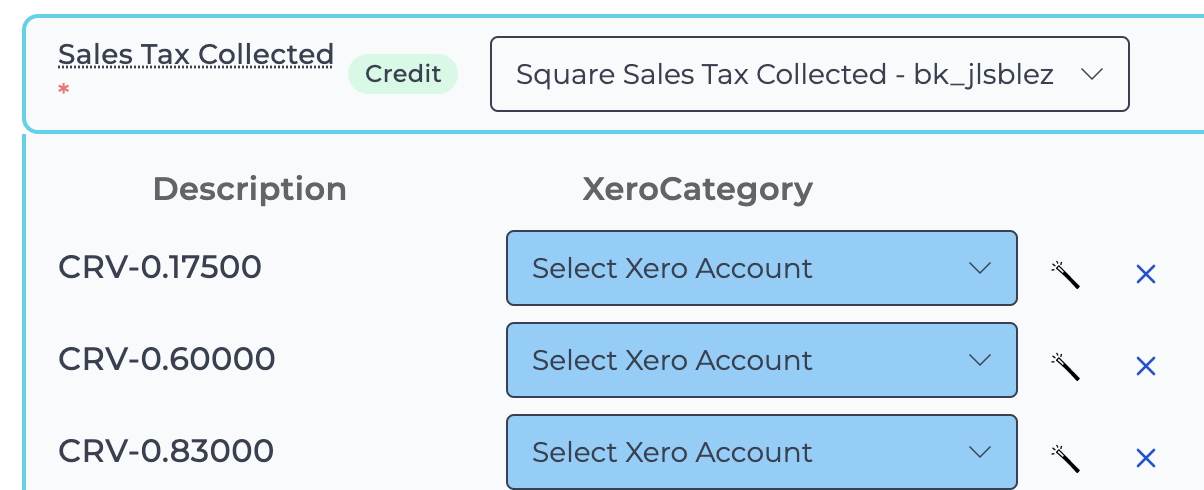

The below example shows various subcategories within the Sales Tax Collected category:

New subcategories may emerge from the source system over time. You can choose to map each subcategory or leave them unmapped; unmapped subcategories will roll into the parent category amount and post accordingly. Mapped subcategories post to their specific accounts.

Remember, all subcategories aggregate into their parent category, ensuring their total equals the category's total.

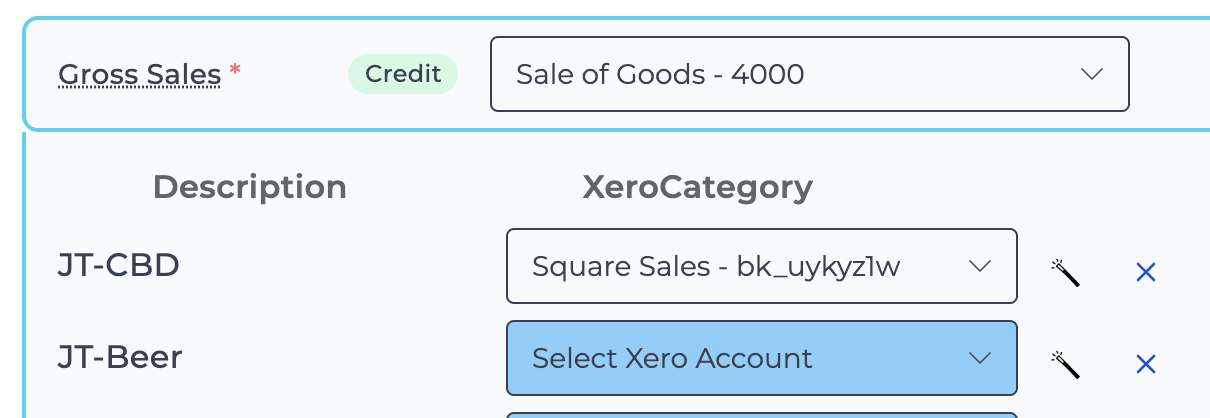

In the example below, the JT-CBD subcategory posts to the mapped Square sales account. The unmapped JT-Beer subcategory, however, aggregates into the Gross Sales category and posts to the Sale of Goods account:

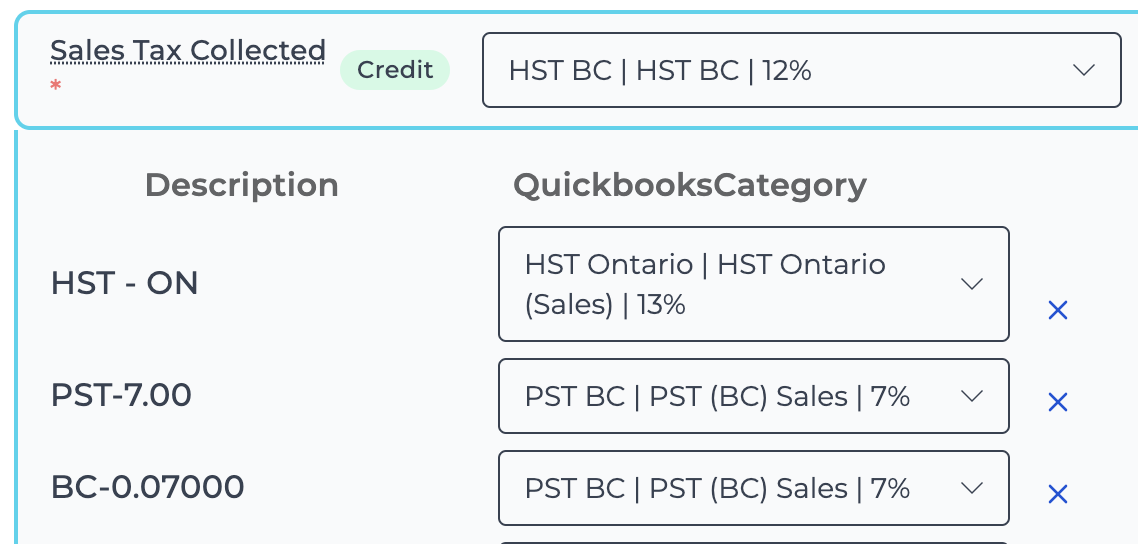

While subcategory mapping is generally optional, certain scenarios—like Canadian sales tax in QuickBooks require meticulous mapping to enable correct tax reporting, similar to the below:

Incomplete mapping in these cases can lead to journal entries failing to post.