QuickBooks Online Canada Sales Tax

This feature is supported with our Clover, MindBody, Square, Shopify, SumUp, and Squarespace app integrations.

When we import data into our system, we use categories and subcategories to display the journal entry lines that you can map to your accounts in your accounting platform.

Normally, subcategories are optional to map, but for Canadian sales tax codes, each line must be mapped, or the posting to QuickBooks may fail. Read on for an example of how we correctly post Canadian sales tax to QuickBooks Online.

After adding new tax codes in QuickBooks, you will want to sync your accounts with Bookkeep to complete your mapping.

Handling Canadian Sales Tax

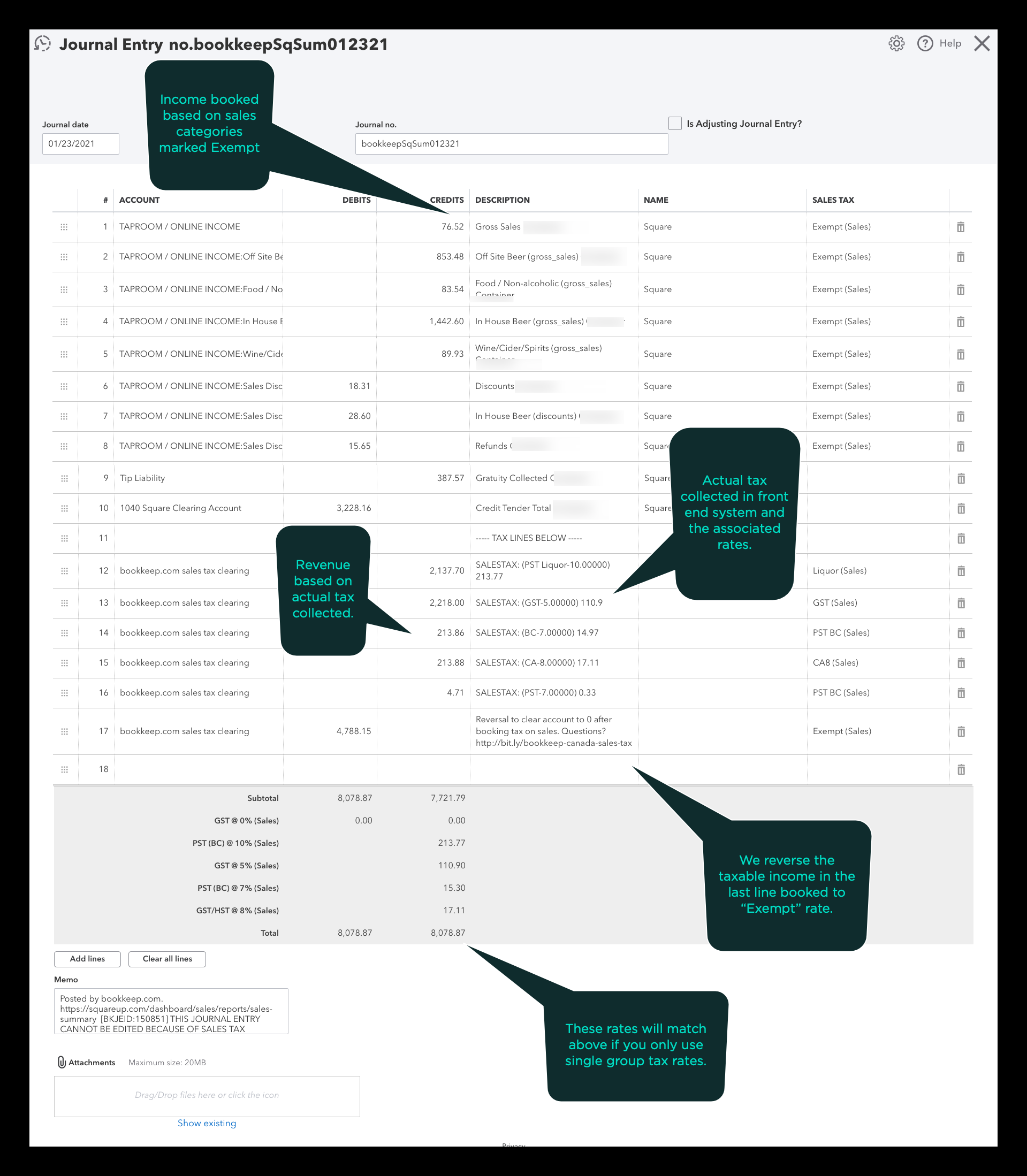

We take the tax collected from the source system (Square, Shopify, etc.) and then include it in the revenue for that tax collected. We do not allow QuickBooks to calculate the tax for you.

We map to single tax rates, so it is best to use single tax codes that map to a single rate and not a group code with different rates. If you use a group rate, QuickBooks will try to recalculate to the group rate, causing complications.

Since we book revenue based on sales categories, which differ from sales tax rates, we back out the revenue in the journal entry used for booking sales tax. The revenue at the top of the journal entry is marked with the "Exempt" tax code, and our back-out revenue is also marked "Exempt." This ensures the correct total amount of sales hits line 101 of the Prepare Return. Any untaxed revenue is shown as Exempt.

For best results, create single (not grouped) rates with the exact rate you are mapping to in Square or Shopify. The Journal Entry in QuickBooks Online calculates based on the group rate, which will cause an error if you manually adjust the journal entry in QuickBooks. It will calculate based on the total group rate, not the single rate we map to in the mapping window.

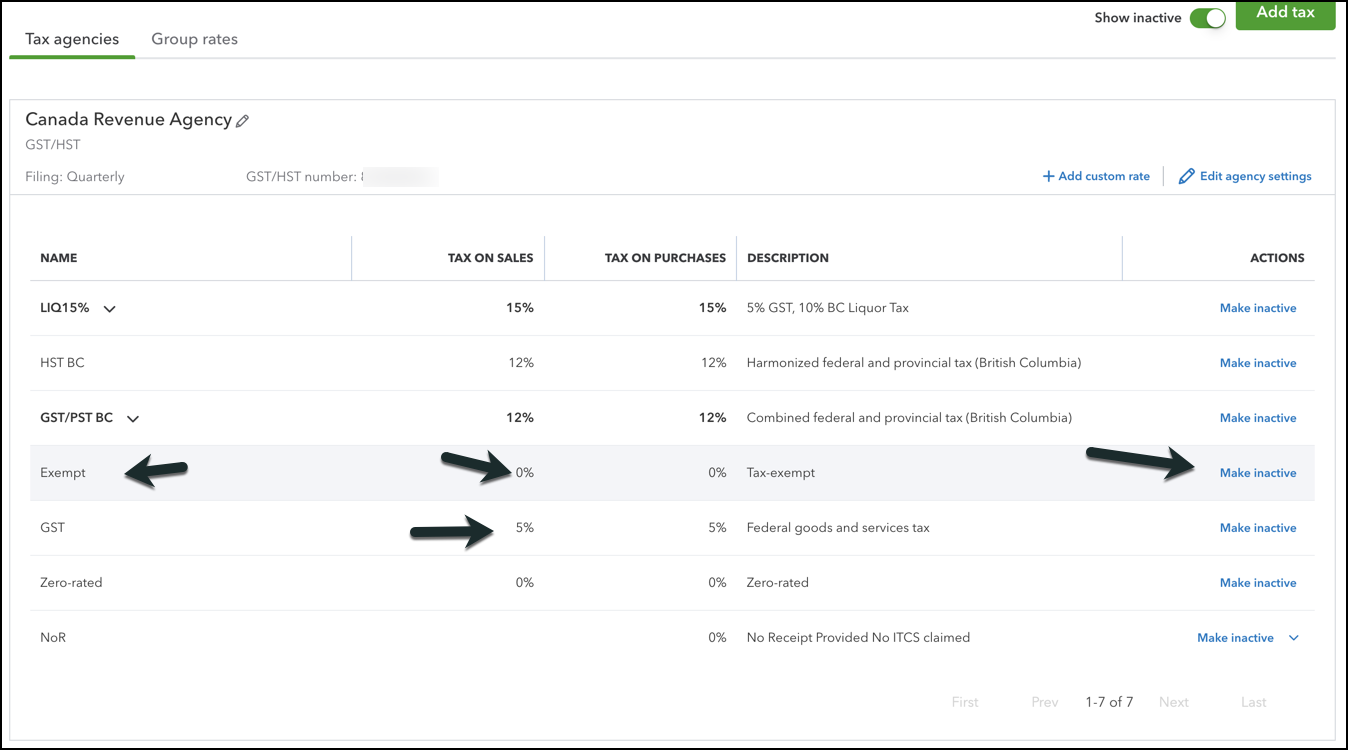

There must be a tax code named "Exempt" for Tax Exempt amounts, and that code must be active.

To verify this::

- Visit https://app.qbo.intuit.com/app/tax/manage.

- Ensure the name says "Exempt" and the line is active (if "Make Inactive" is present, it's active).

- Ensure any rates here have a Tax on Sales Amount set.

Below is a journal entry with sales tax for Canadian QuickBooks Online:

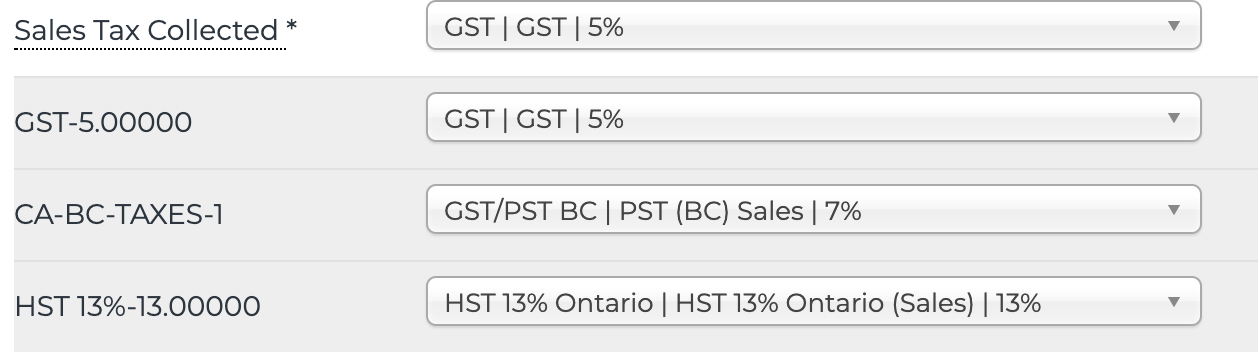

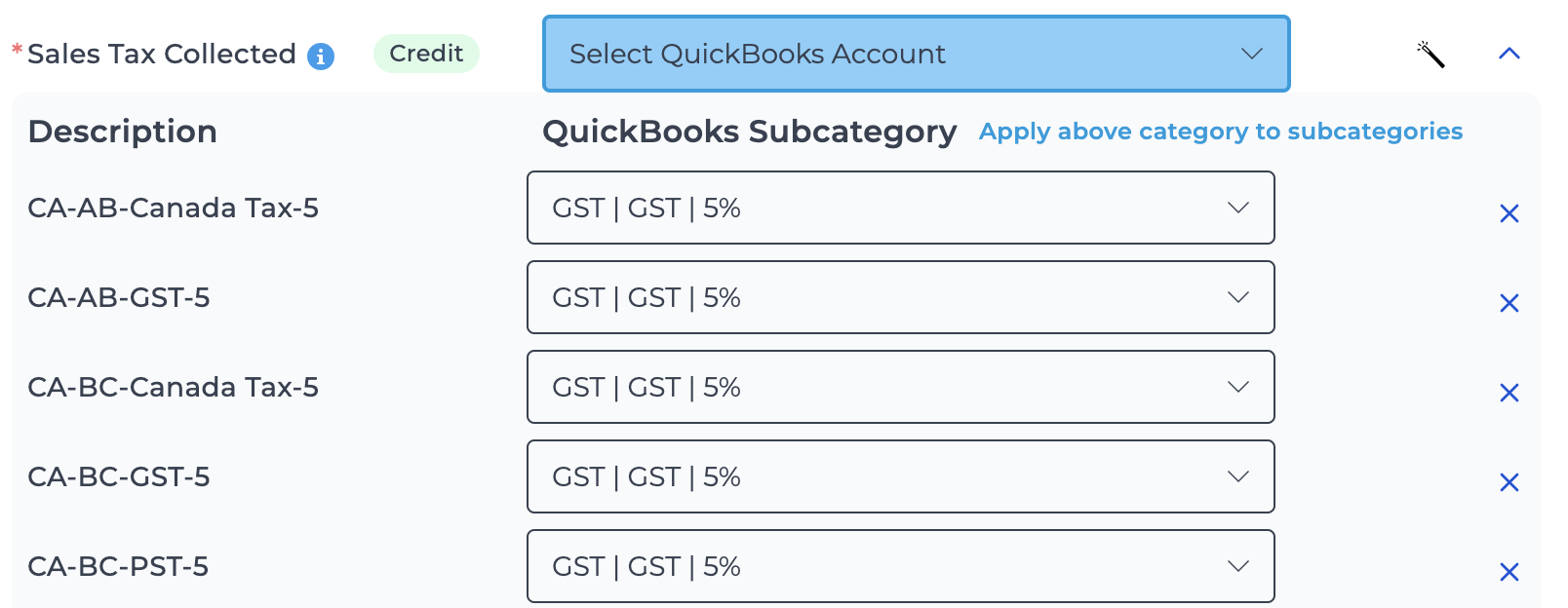

For customers using QuickBooks tax rates, you may notice that the "Sales Tax Collected" category allows mapping to an account, while individual subcategories can be mapped to a QuickBooks tax rate. This setup is intentional to accommodate cases where both U.S. and Canadian tax rates appear in the same system.

- Canadian tax subcategories are posted to their respective QuickBooks tax rates.

- U.S. tax subcategories can be mapped to specific accounts. If a U.S. tax rate is not mapped, the top-level "Sales Tax Collected" category serves as a catch-all account.

This approach primarily applies to Shopify transactions where mixed U.S. and Canadian tax rates exist. See below for an example:

If you have any questions, please feel free to contact [email protected].