Important considerations for Shopify stores selling on Facebook or Instagram

Key Information for Using Shopify to Sell on Facebook or Instagram

Shopify allows you to sell your products on Facebook and Instagram using the Facebook & Instagram app on Shopify. Meta/Facebook offers details here about the integration.

Important Points for Accountants or Controllers

Sales Tax Collection: Sales tax is generally collected and paid by Meta for sales through this channel. Verify this to ensure you do not overpay sales tax.

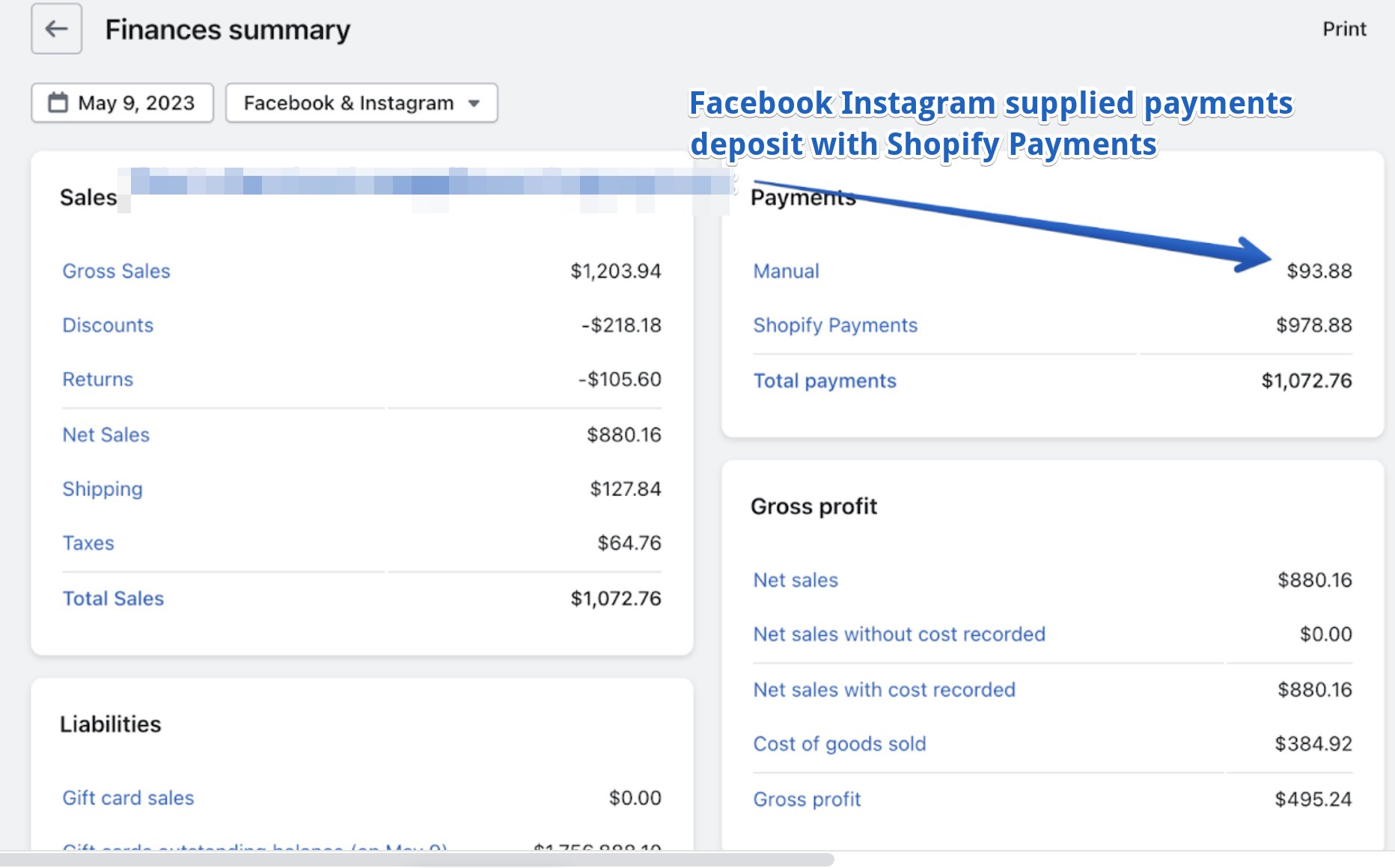

Channel Promotion Credits: Meta occasionally offers coupons/discounts reimbursed to you, appearing as "Manual" in your payments. These reimbursements are deposited with your Shopify Payments payouts and are often labeled as "Channel Promotion Credit" in the Shopify payout interface but may show up as a generic adjustment. More details are provided below:

Sales Tax Collected and Withheld

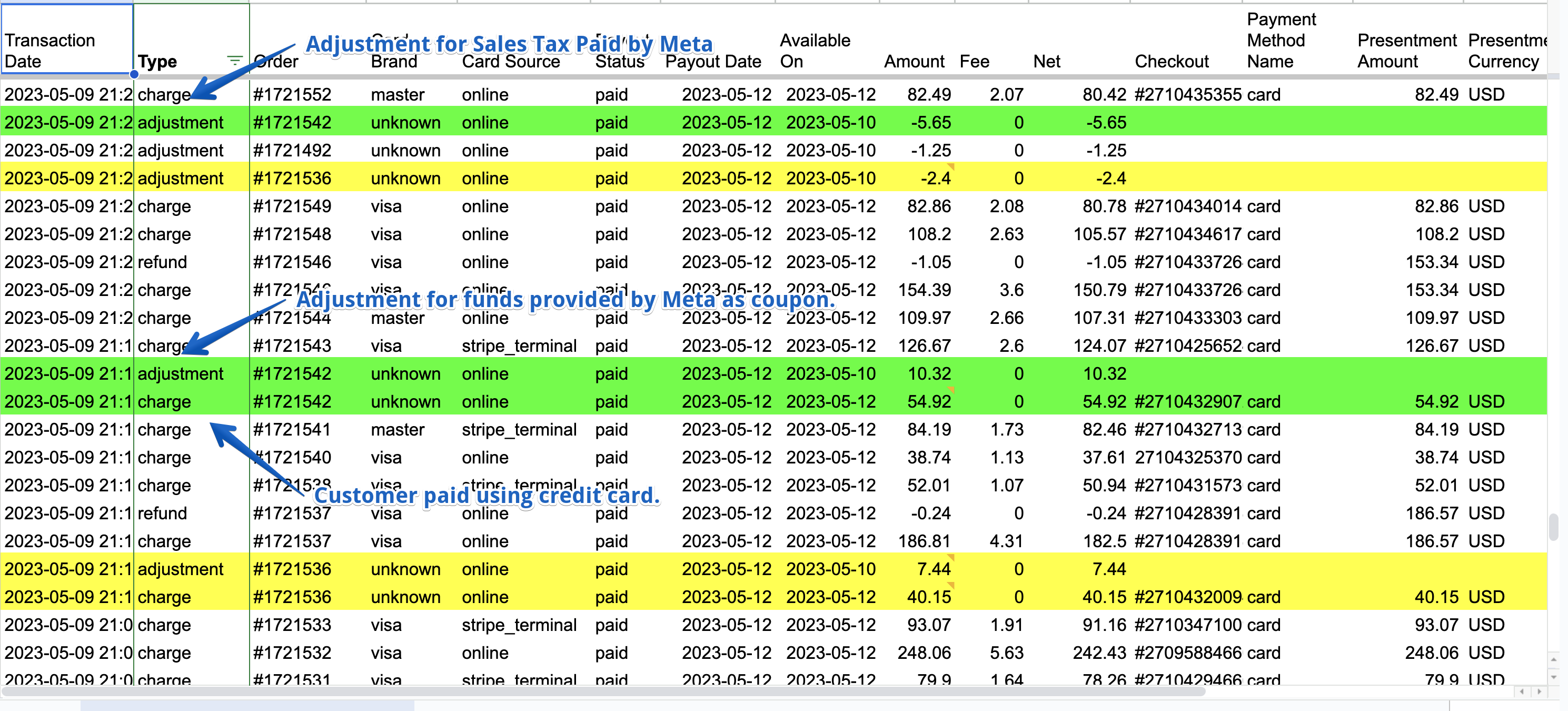

Adjustments are commonly made during the payout process for sales on the Facebook or Instagram channel. These adjustments are linked by the order ID and typically involve withholding sales tax from a Shopify payout, as Facebook handles the remittance. In the example below, highlighted in the top green row, an adjustment of -5.65 for order #1721542 is shown. The deposit detail doesn't explain this, so we need to look at the order notes:

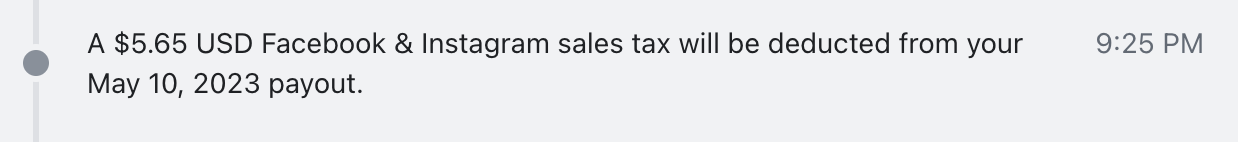

When you go to the notes you see this for order #1721542:

This indicates that these taxes were withheld and paid by Facebook, ensuring you don't double-pay the sales tax.

Bookkeep captures the sales tax collected and withheld to prevent overpayment. Learn more about our solution.

Channel Promotion Credits

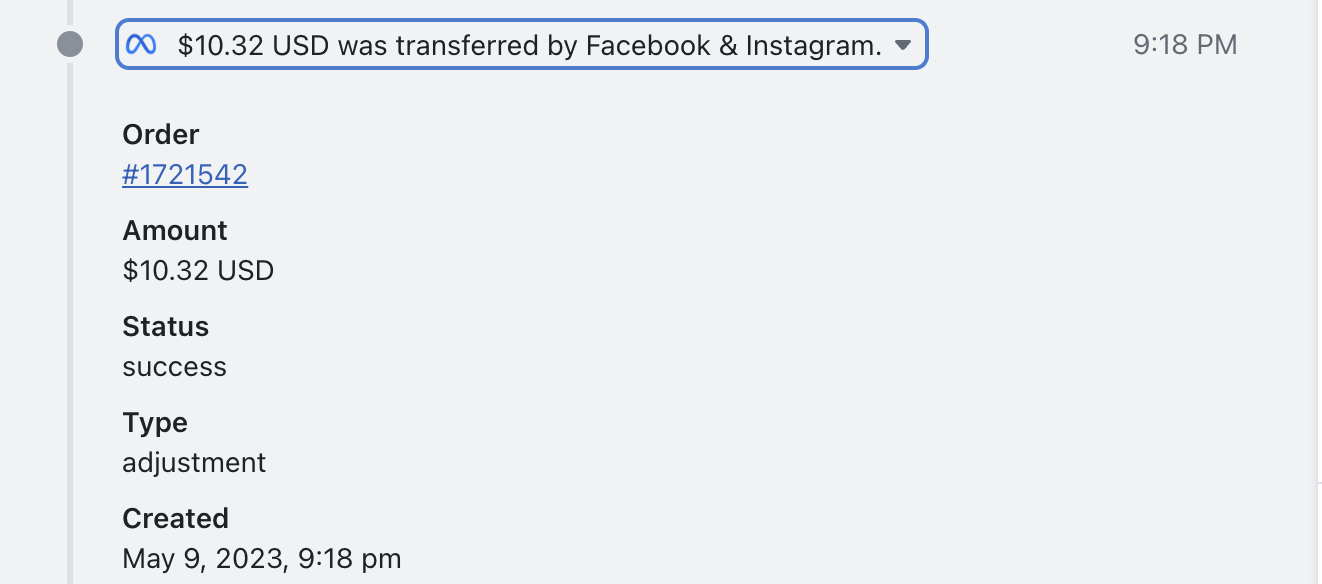

In the example above, a positive adjustment for order #172542 in the middle green row is highlighted for 10.32. The order notes show this:

Here, the customer is not paying the full amount, and Meta is reimbursing the remaining balance. These funds are deposited with your Shopify Payments payout but are marked as Manual payments:

To correct this, filter to the Facebook & Instagram Channel in your Shopify Reporting at the end of the month and do an adjusting entry to transfer from Manual Payments to your Shopify Payments Balance account.

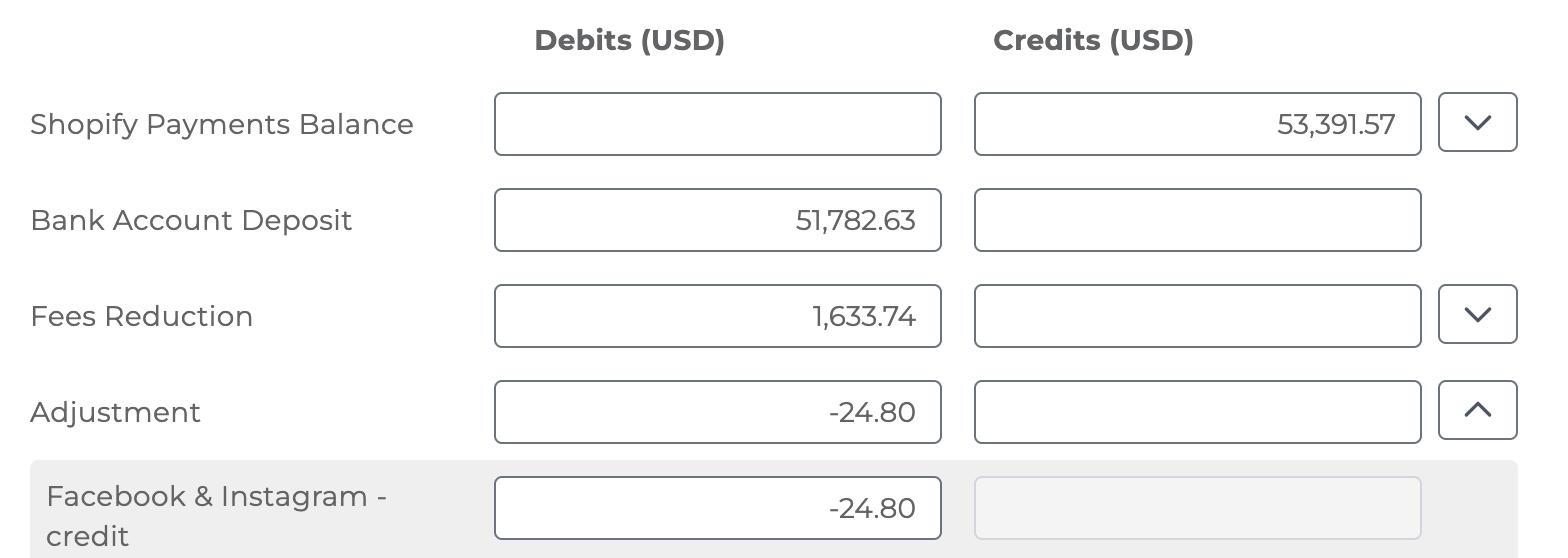

Bookkeep recently added the capability to identify these adjustments and label them more clearly. For "Channel Promotion Credits," we label them as "Facebook & Instagram - credit" or "Facebook & Instagram - debit," depending on whether an order is being paid out or refunded. This allows you to map these adjustments to your Manual Payments balance.

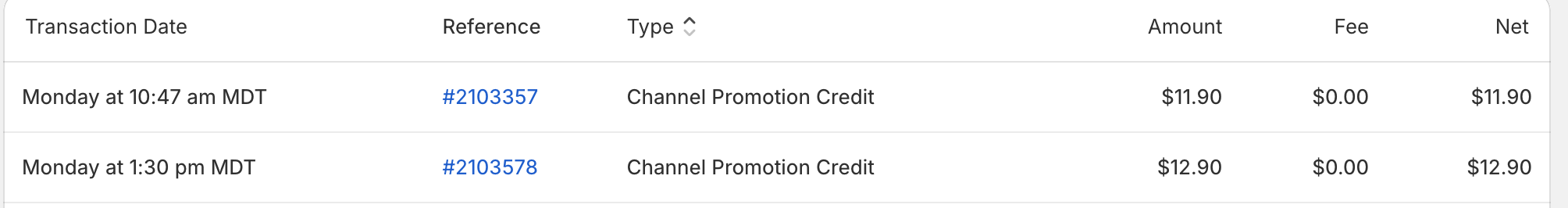

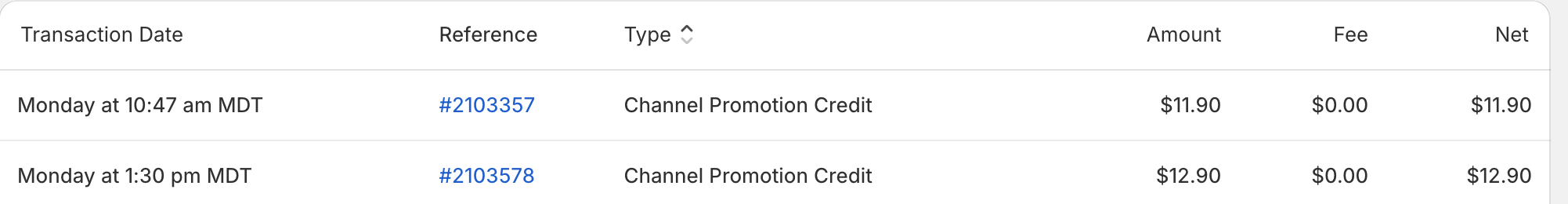

In Shopify, this payout/deposit shows two orders from Facebook with a channel promotion credit:

Bookkeep is able to identify these adjustments and label them as "Facebook & Instagram - credit" as shown below (11.90+12.90 = 24.80):

Understanding these adjustments within a Shopify payout is crucial for reconciling your balance accounts. Knowing how sales tax is handled and any reimbursements from Meta/Facebook ensures accurate financial tracking and prevents overpayment. This knowledge empowers you to manage your Shopify store's financial transactions confidently and streamline your accounting processes.

Our team is ready to assist with this or any other challenges you encounter with Shopify. Feel free to contact us at [email protected].