Shopify Sales Tax Withheld

Bookkeep captures "Sales Tax Withheld" data for sales channels in Shopify that collect and withhold sales tax on behalf of the seller. For affected accounts, map "Sales Tax Withheld" to the same account as "Sales Tax Collected" and any sub-accounts.

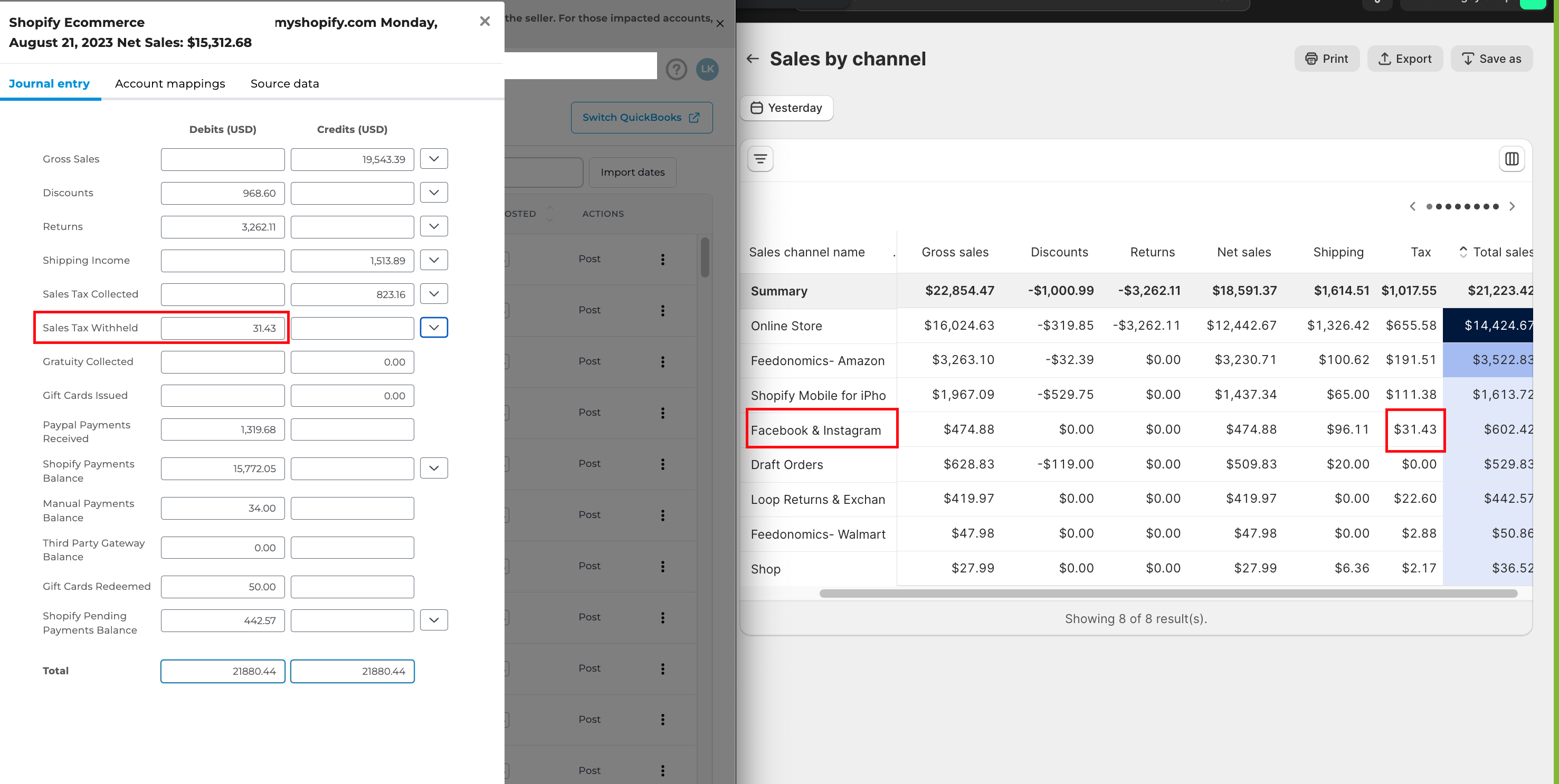

For example, items sold via Facebook with sales tax collected result in sales tax commonly withheld by Facebook. We capture this withheld portion to ensure you are not overpaying your sales tax liability.

When merchants sell on multiple sales channels, it can be difficult to determine whether the merchant or the sales channel is responsible for remitting sales taxes. Most marketplaces are the liable party for sales tax and should be excluded from merchant sales tax filings.

This addition helps merchants know when another party is responsible for sales tax remittance, clarifying the tax they are responsible for.

In the example below, you will see how sales tax withheld for Shopify ties out to the sales by channel report available in the Shopify dashboard.

If you have any questions, feel free to contact [email protected].